Question: Question 3 (20 marks) A fund manager is managing the following 4-stock portfolio in Hong Kong. The stock index futures contract is currently trading at

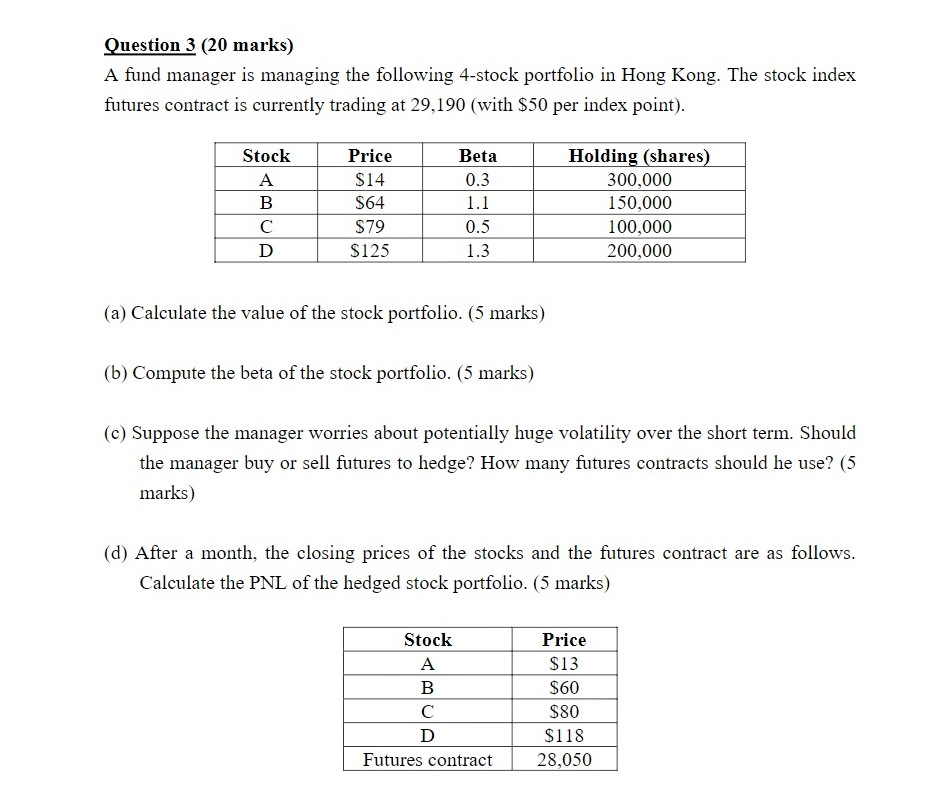

Question 3 (20 marks) A fund manager is managing the following 4-stock portfolio in Hong Kong. The stock index futures contract is currently trading at 29,190 (with $50 per index point). Beta Stock A 0.3 Price S14 64 $79 $125 1.1 0.5 1.3 Holding (shares) 300,000 150,000 100,000 200,000 D (a) Calculate the value of the stock portfolio. (5 marks) (b) Compute the beta of the stock portfolio. (5 marks) (c) Suppose the manager worries about potentially huge volatility over the short term. Should the manager buy or sell futures to hedge? How many futures contracts should he use? (5 marks) (d) After a month, the closing prices of the stocks and the futures contract are as follows. Calculate the PNL of the hedged stock portfolio. (5 marks) Stock B Price $13 $60 $80 $118 28,050 Futures contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts