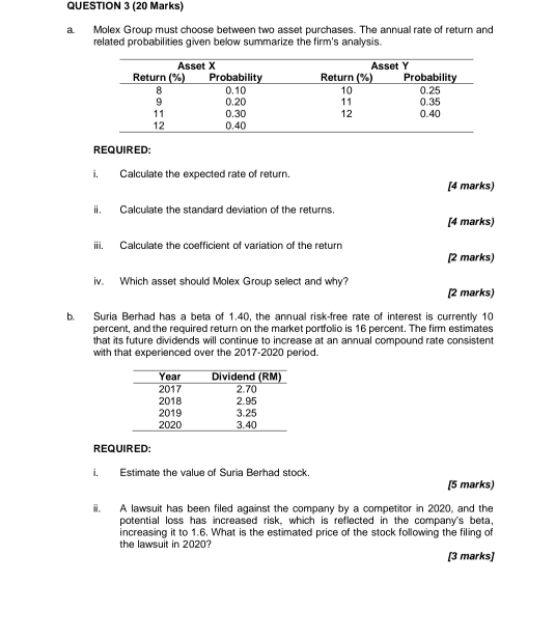

Question: QUESTION 3 (20 Marks) a Molex Group must choose between two asset purchases. The annual rate of return and related probabilities given below summarize the

QUESTION 3 (20 Marks) a Molex Group must choose between two asset purchases. The annual rate of return and related probabilities given below summarize the firm's analysis. Asset x Asset Y Return (%) Probability Return (%) Probability 0.10 10 0.25 9 0.20 11 0.35 11 0.30 12 0.40 12 0.40 REQUIRED: i. Calculate the expected rate of return [4 marks) Calculate the standard deviation of the returns. (4 marks) Calculate the coefficient of variation of the return 2 marks) iv. Which asset should Molex Group select and why? [2 marks) b. Suria Berhad has a beta of 1.40, the annual risk-free rate of interest is currently 10 percent, and the required return on the market portfolio is 16 percent. The firm estimates that its future dividends will continue to increase at an annual compound rate consistent with that experienced over the 2017-2020 period. Year Dividend (RM) 2017 2.70 2018 2.95 2019 3.25 2020 3.40 REQUIRED: Estimate the value of Suria Berhad stock. 15 marks) A lawsuit has been filed against the company by a competitor in 2020, and the potential loss has increased risk. which is reflected in the company's beta increasing it to 1.6. What is the estimated price of the stock following the filing of the lawsuit in 2020? [3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts