Question: Question 3 [20 Marks) a) Suppose that there is a Ghc 1,000,000 preference share with 15% annual dividend rate, and required rate of return is

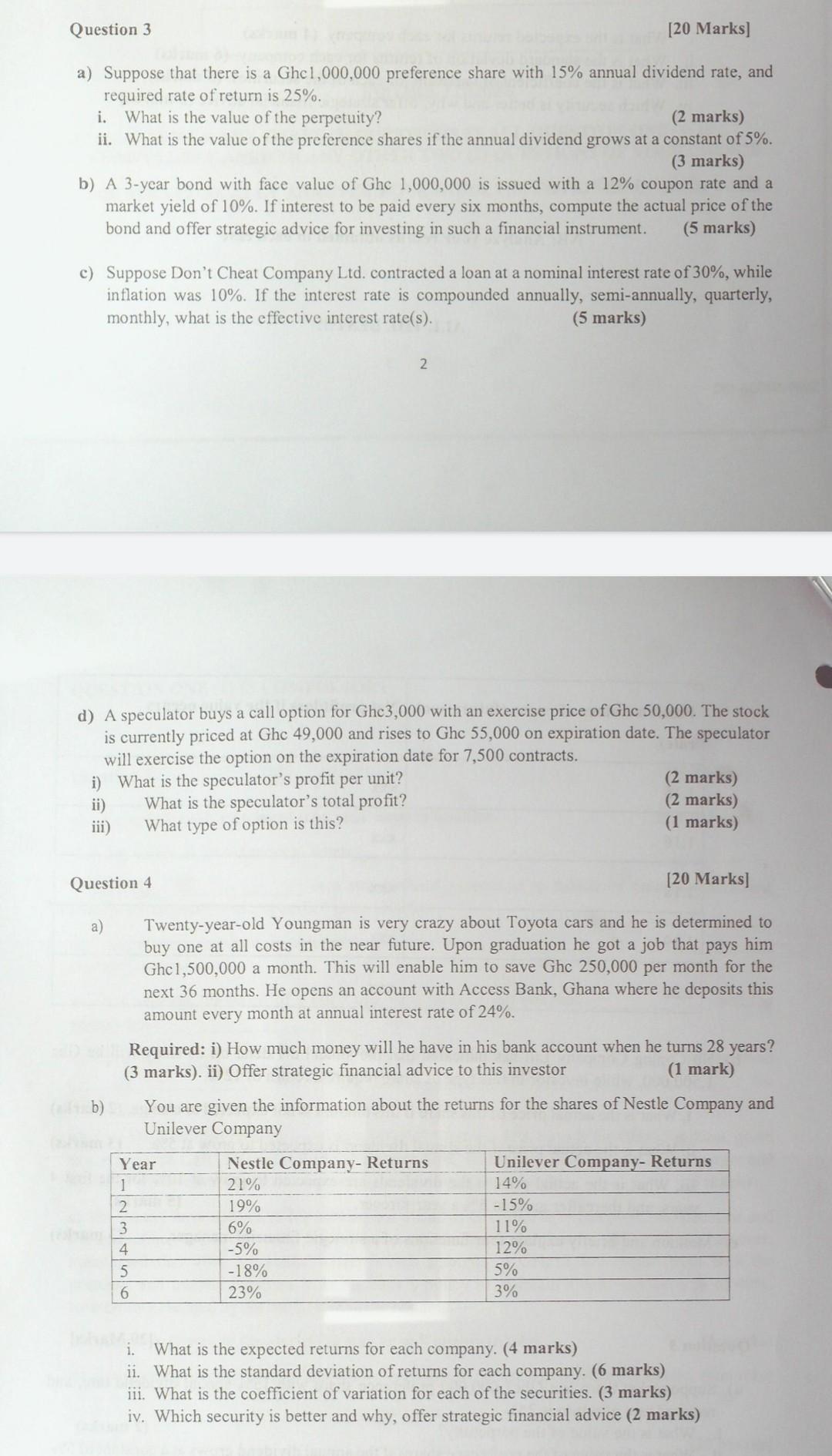

Question 3 [20 Marks) a) Suppose that there is a Ghc 1,000,000 preference share with 15% annual dividend rate, and required rate of return is 25%. i. What is the value of the perpetuity? (2 marks) ii. What is the value of the preference shares if the annual dividend grows at a constant of 5%. (3 marks) b) A 3-year bond with face value of Ghc 1,000,000 is issued with a 12% coupon rate and a market yield of 10%. If interest to be paid every six months, compute the actual price of the bond and offer strategic advice for investing in such a financial instrument. (5 marks) c) Suppose Don't Cheat Company Ltd. contracted a loan at a nominal interest rate of 30%, while inflation was 10%. If the interest rate is compounded annually, semi-annually, quarterly, monthly, what is the effective interest rate(s). (5 marks) 2. d) A speculator buys a call option for Ghc3,000 with an exercise price of Ghc 50,000. The stock is currently priced at Ghc 49,000 and rises to Ghc 55,000 on expiration date. The speculator will exercise the option on the expiration date for 7,500 contracts. i) What is the speculator's profit per unit? (2 marks) ii) What is the speculator's total profit? (2 marks) iii) What type of option is this? (1 marks) Question 4 [20 Marks] a) Twenty-year-old Youngman is very crazy about Toyota cars and he is determined to buy one at all costs in the near future. Upon graduation he got a job that pays him Ghc1,500,000 a month. This will enable him to save Ghc 250,000 per month for the next 36 months. He opens an account with Access Bank, Ghana where he deposits this amount every month at annual interest rate of 24%. b) Required: i) How much money will he have in his bank account when he turns 28 years? (3 marks). ii) Offer strategic financial advice to this investor (1 mark) You are given the information about the returns for the shares of Nestle Company and Unilever Company Year Nestle Company- Returns Unilever Company- Returns 1 21% 14% 2 19% -15% 3 6% 11% 4 -5% 12% 5 -18% 5% 6 23% 3% i. What is the expected returns for each company. (4 marks) ii. What is the standard deviation of returns for each company. (6 marks) iii. What is the coefficient of variation for each of the securities. (3 marks) iv. Which security is better and why, offer strategic financial advice (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts