Question: QUESTION 3 (20 MARKS) Alan, Alex, John and Bob are brothers. They're all serious investors, but each has different approach to valuing stocks. Alan, the

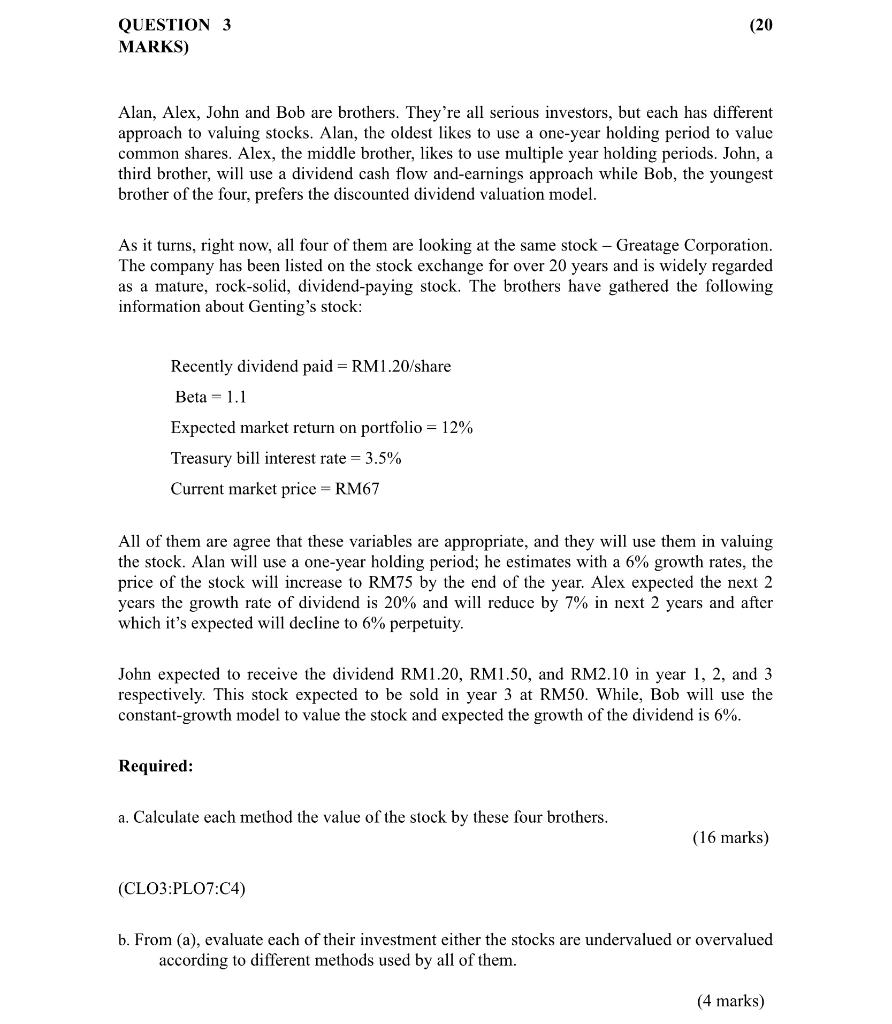

QUESTION 3 (20 MARKS) Alan, Alex, John and Bob are brothers. They're all serious investors, but each has different approach to valuing stocks. Alan, the oldest likes to use a one-year holding period to value common shares. Alex, the middle brother, likes to use multiple year holding periods. John, a third brother, will use a dividend cash flow and-earnings approach while Bob, the youngest brother of the four, prefers the discounted dividend valuation model. As it turns, right now, all four of them are looking at the same stock - Greatage Corporation. The company has been listed on the stock exchange for over 20 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about Genting's stock: Recently dividend paid = RM 1.20/ share Beta =1.1 Expected market return on portfolio =12% Treasury bill interest rate =3.5% Current market price = RM67 All of them are agree that these variables are appropriate, and they will use them in valuing the stock. Alan will use a one-year holding period; he estimates with a 6% growth rates, the price of the stock will increase to RM75 by the end of the year. Alex expected the next 2 years the growth rate of dividend is 20% and will reduce by 7% in next 2 years and after which it's expected will decline to 6% perpetuity. John expected to receive the dividend RM1.20, RM1.50, and RM2.10 in year 1, 2, and 3 respectively. This stock expected to be sold in year 3 at RM50. While, Bob will use the constant-growth model to value the stock and expected the growth of the dividend is 6%. Required: a. Calculate each method the value of the stock by these four brothers. (16 marks) (CLO3:PLO7:C4) b. From (a), evaluate each of their investment either the stocks are undervalued or overvalued according to different methods used by all of them. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts