Question: QUESTION 3 (20 MARKS) Design plus is able to sell 300000 units of its product per year for the next three years at a price

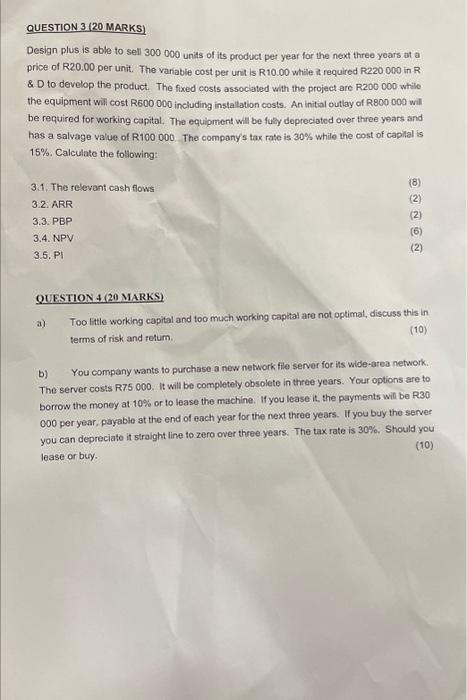

QUESTION 3 (20 MARKS) Design plus is able to sell 300000 units of its product per year for the next three years at a price of R20.00 per unit. The variable cost per unit is R10.00 while it required R220.000 in R &D to develop the product. The fixed costs associated with the project are R200 000 while the equipment will cost R600 000 including installation costs. An inital outlay of R800000 will be required for working capital. The equipment will be fully depreciated over three years and has a salvage value of R100 000 . The company's tax rate is 30% while the cost of capital is 15%. Calculate the following: 3.1. The relevant cash flows (8) 3.2. ARR (2) 3.3. PBP (2) (6) 3.4. NPV (2) 3.5. PI QUESTION 4 (20 MARKS) a) Too little working capital and too much working capital are not optimal, discuss this in terms of risk and retum. b) You company wants to purchase a new network file server for ins wide-area network. The server costs R75 000. It will be completely obsolete in three years. Your options are to borrow the money at 10% or to lease the machine. If you lease it, the payments will be R30 000 per year, payable at the end of each year for the next three years. If you buy the server you can depreciato it straight line to zero over three years. The tax rate is 30%. Should you (10) lease or buy. QUESTION 3 (20 MARKS) Design plus is able to sell 300000 units of its product per year for the next three years at a price of R20.00 per unit. The variable cost per unit is R10.00 while it required R220.000 in R &D to develop the product. The fixed costs associated with the project are R200 000 while the equipment will cost R600 000 including installation costs. An inital outlay of R800000 will be required for working capital. The equipment will be fully depreciated over three years and has a salvage value of R100 000 . The company's tax rate is 30% while the cost of capital is 15%. Calculate the following: 3.1. The relevant cash flows (8) 3.2. ARR (2) 3.3. PBP (2) (6) 3.4. NPV (2) 3.5. PI QUESTION 4 (20 MARKS) a) Too little working capital and too much working capital are not optimal, discuss this in terms of risk and retum. b) You company wants to purchase a new network file server for ins wide-area network. The server costs R75 000. It will be completely obsolete in three years. Your options are to borrow the money at 10% or to lease the machine. If you lease it, the payments will be R30 000 per year, payable at the end of each year for the next three years. If you buy the server you can depreciato it straight line to zero over three years. The tax rate is 30%. Should you (10) lease or buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts