Question: Question 3 (20 marks) Part A: (1) List two examples of direct costs of financial distress. (2 marks) (2) List four examples of indirect costs

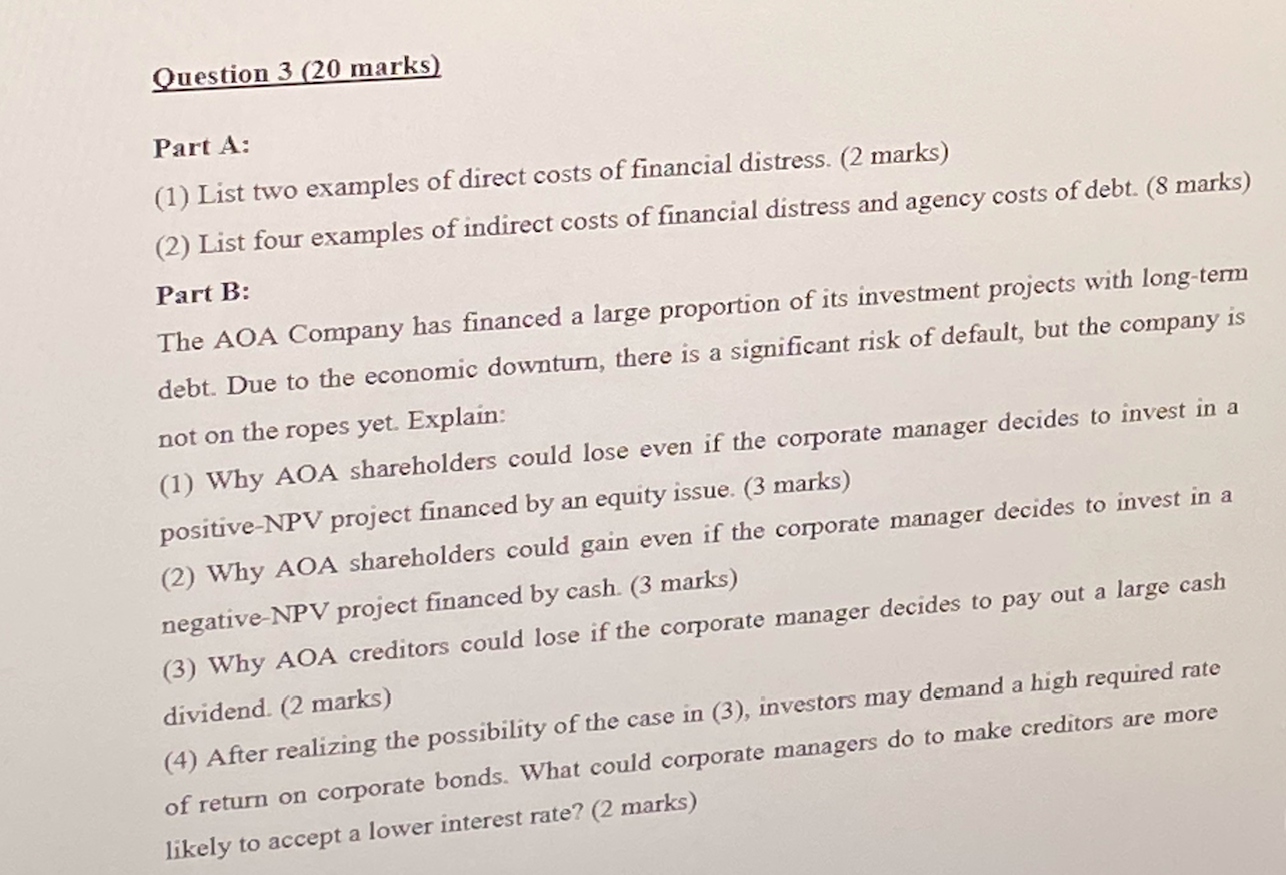

Question 3 (20 marks) Part A: (1) List two examples of direct costs of financial distress. (2 marks) (2) List four examples of indirect costs of financial distress and agency costs of debt. (8 marks) Part B: The AOA Company has financed a large proportion of its investment projects with long-term debt. Due to the economic downtum, there is a significant risk of default, but the company is not on the ropes yet. Explain: (1) Why AOA shareholders could lose even if the corporate manager decides to invest in a positive-NPV project financed by an equity issue. (3 marks) (2) Why AOA shareholders could gain even if the corporate manager decides to invest in a negative-NPV project financed by cash. (3 marks) (3) Why AOA creditors could lose if the corporate manager decides to pay out a large cash dividend. (2 marks) (4) After realizing the possibility of the case in (3), investors may demand a high required rate of return on corporate bonds. What could corporate managers do to make creditors are more likely to accept a lower interest rate? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts