Question: Question 3 (20 marks) Professional Ltd has a tax rate of 25%. It has 36,000 shares of stock outstanding with a beta of 1.2 and

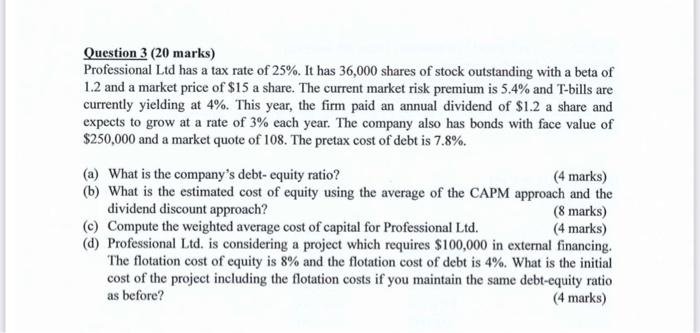

Question 3 (20 marks) Professional Ltd has a tax rate of 25%. It has 36,000 shares of stock outstanding with a beta of 1.2 and a market price of $15 a share. The current market risk premium is 5.4% and T-bills are currently yielding at 4%. This year, the firm paid an annual dividend of $1.2 a share and expects to grow at a rate of 3% each year. The company also has bonds with face value of $250,000 and a market quote of 108. The pretax cost of debt is 7.8%. (a) What is the company's debt-equity ratio? (4 marks) (b) What is the estimated cost of equity using the average of the CAPM approach and the dividend discount approach? (8 marks) (c) Compute the weighted average cost of capital for Professional Ltd. (4 marks) (d) Professional Ltd. is considering a project which requires $100,000 in external financing. The flotation cost of equity is 8% and the flotation cost of debt is 4%. What is the initial cost of the project including the flotation costs if you maintain the same debt-equity ratio as before? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts