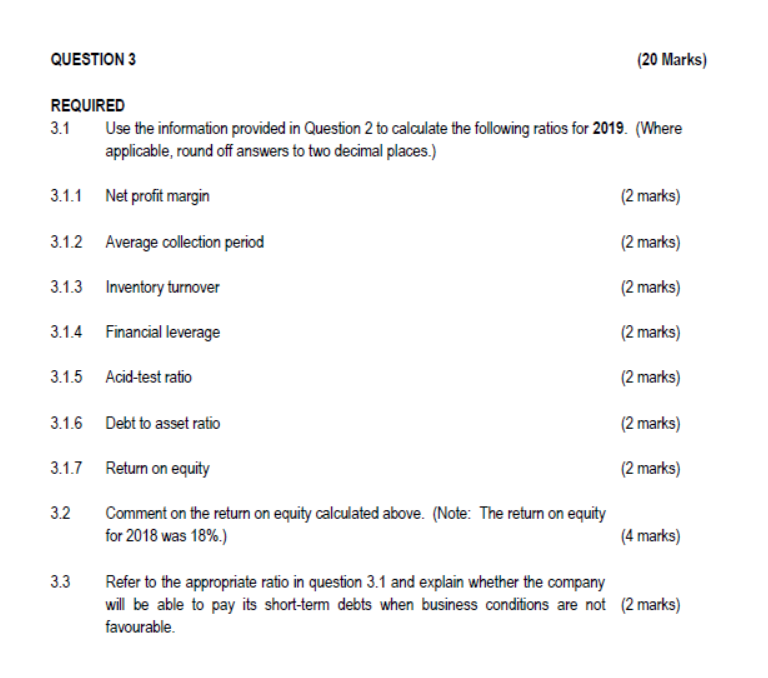

Question: QUESTION 3 (20 Marks) REQUIRED 3.1 Use the information provided in Question 2 to calculate the following ratios for 2019. (Where applicable, round off answers

QUESTION 3 (20 Marks) REQUIRED 3.1 Use the information provided in Question 2 to calculate the following ratios for 2019. (Where applicable, round off answers to two decimal places.) 3.1.1 Net profit margin 3.1.2 Average collection period 3.1.3 Inventory turnover 3.1.4 Financial leverage 3.1.5 Acid-test ratio 3.1.6 Debt to asset ratio 3.1.7 Return on equity (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) 3.2 Comment on the return on equity calculated above. (Note: The return on equity for 2018 was 18%.) ( 4 marks) 3.3 Refer to the appropriate ratio in question 3.1 and explain whether the company will be able to pay its short-term debts when business conditions are not ( 2 marks) ( 2 marks) favourable. QUESTION 3 (20 Marks) REQUIRED 3.1 Use the information provided in Question 2 to calculate the following ratios for 2019. (Where applicable, round off answers to two decimal places.) 3.1.1 Net profit margin 3.1.2 Average collection period 3.1.3 Inventory turnover 3.1.4 Financial leverage 3.1.5 Acid-test ratio 3.1.6 Debt to asset ratio 3.1.7 Return on equity (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) 3.2 Comment on the return on equity calculated above. (Note: The return on equity for 2018 was 18%.) ( 4 marks) 3.3 Refer to the appropriate ratio in question 3.1 and explain whether the company will be able to pay its short-term debts when business conditions are not ( 2 marks) ( 2 marks) favourable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts