Question: QUESTION 3 (20 MARKS) REQUIRED Calculate the following from the information provided below: 3.1 The total Marginal Income and Net Profit/Loss if all 10 000

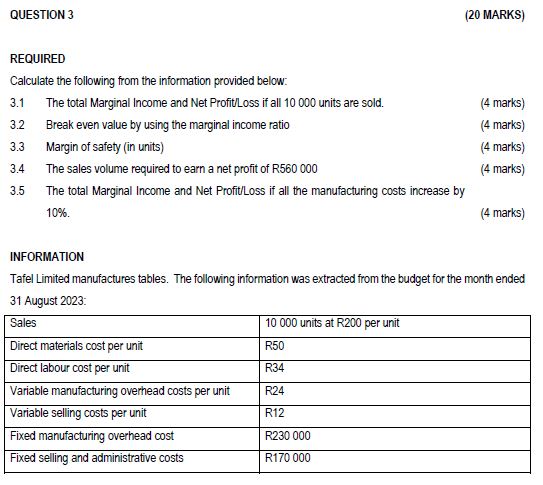

QUESTION 3 (20 MARKS) REQUIRED Calculate the following from the information provided below:

3.1 The total Marginal Income and Net Profit/Loss if all 10 000 units are sold. (4 marks)

3.2 Break even value by using the marginal income ratio (4 marks)

3.3 Margin of safety (in units) (4 marks)

3.4 The sales volume required to earn a net profit of R560 000 (4 marks)

3.5 The total Marginal Income and Net Profit/Loss if all the manufacturing costs increase by 10%. (4 marks) INFORMATION Tafel Limited manufactures tables.

The following information was extracted from the budget for the month ended 31 August 2023:

Sales 10 000 units at R200 per unit Direct materials cost per unit R50 Direct labour cost per unit R34 Variable manufacturing overhead costs per unit R24 Variable selling costs per unit R12 Fixed manufacturing overhead cost R230 000 Fixed selling and administrative costs R170 000 REQUIRED Calculate the following from the information provided below: 3.1 The total Marginal Income and Net ProfitlLoss if all 10000 units are sold. (4 marks) 3.2 Break even value by using the marginal income ratio (4 marks) 3.3 Margin of safety (in units) (4 marks) 3.4 The sales volume required to earn a net profit of R560 000 (4 marks) 3.5 The total Marginal Income and Net Profitlloss if all the manufacturing costs increase by 10%. (4 marks) INFORMATION Tafel Limited manufactures tables. The following information was extracted from the budget for the month ended 31 August 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts