Question: QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to calculate the overhead cost per product using the 3.1 Traditional Absorption Costing System, with

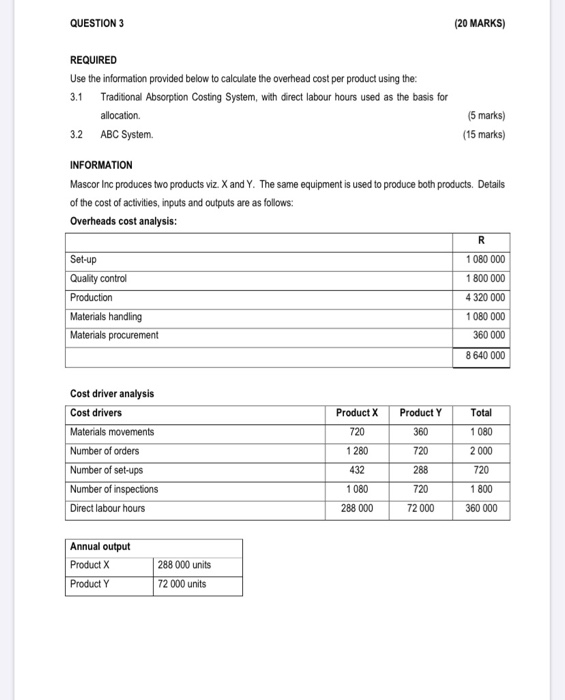

QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to calculate the overhead cost per product using the 3.1 Traditional Absorption Costing System, with direct labour hours used as the basis for allocation 3.2 ABC System (5 marks) (15 marks) INFORMATION Mascor Inc produces two products viz X and Y. The same equipment is used to produce both products. Details of the cost of activities, inputs and outputs are as follows: Overheads cost analysis: R Set-up Quality control Production Materials handling Materials procurement 1 080 000 1 800 000 4320 000 1 080 000 360 000 8 640 000 Product X Product Y Total 720 360 1 080 Cost driver analysis Cost drivers Materials movements Number of orders Number of set-ups Number of inspections Direct labour hours 720 1 280 432 2 000 720 288 1 800 1 080 288 000 720 72 000 360 000 Annual output Product X Product Y 288 000 units 72 000 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts