Question: QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to answer the following questions: 3.1 Calculate the following ratios for 2020 only. Express the

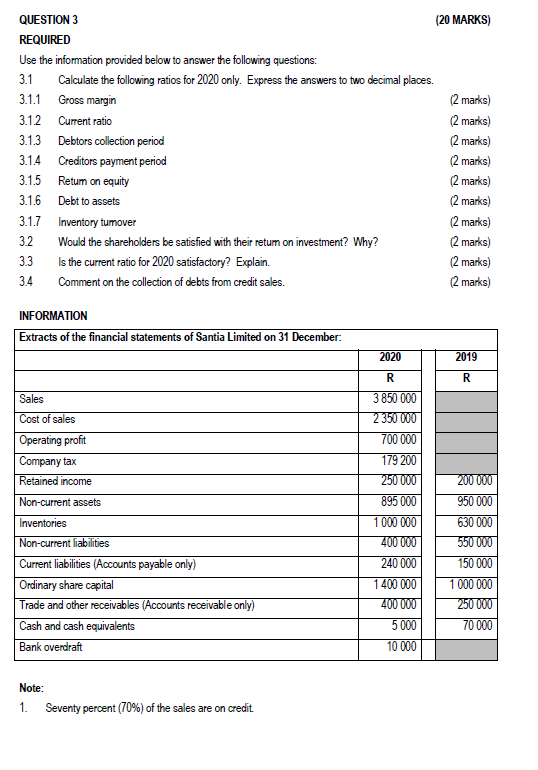

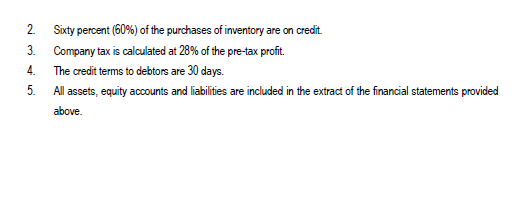

QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to answer the following questions: 3.1 Calculate the following ratios for 2020 only. Express the answers to two decimal places. 3.1.1 Gross margin (2 marks) 3.12 Current ratio 3.13 Debtors collection period 3.1.4 Creditors payment period 3.15 Retum on equity 3.1.6 Debt to assets 3.1.7 Inventory tumover (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) 32 Would the shareholders be satisfied with their retum on investment? Why? (2 marks) (2 marks) (2 marks) (2 marks) 3.3 Is the current ratio for 2020 satisfactory? Explain. 3.4 Comment on the collection of debts from credit sales. INFORMATION Extracts of the financial statements of Santia Limited on 31 December 2020 2019 R R Sales Cost of sales Operating profit Company tax Retained income Non-current assets Inventories 3 850 000 2 350 000 700 000 179 200 250 000 895 000 1 000 000 400 000 240 000 1 400 000 400 000 5 000 10 000 Non-current liabilities 200 000 950 000 630 000 550 000 150 000 1 000 000 250 000 70 000 Current liabilities (Accounts payable only) Ordinary share capital Trade and other receivables (Accounts receivable only) Cash and cash equivalents Bank overdraft Note: 1. Seventy percent (70%) of the sales are on credit 2 Sixty percent (60%) of the purchases of inventory are on credit. 3. Company tax is calculated at 28% of the pre-tax profit. 4 The credit terms to debtors are 30 days. 5. All assets, equity accounts and liabilities are included in the extract of the financial statements provided above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts