Question: Question 3 - 20 Marks Requirement 1 Use Excel to prepare depreciation schedules for straight -line , double -declining -balance , and Requirement 2 Prepare

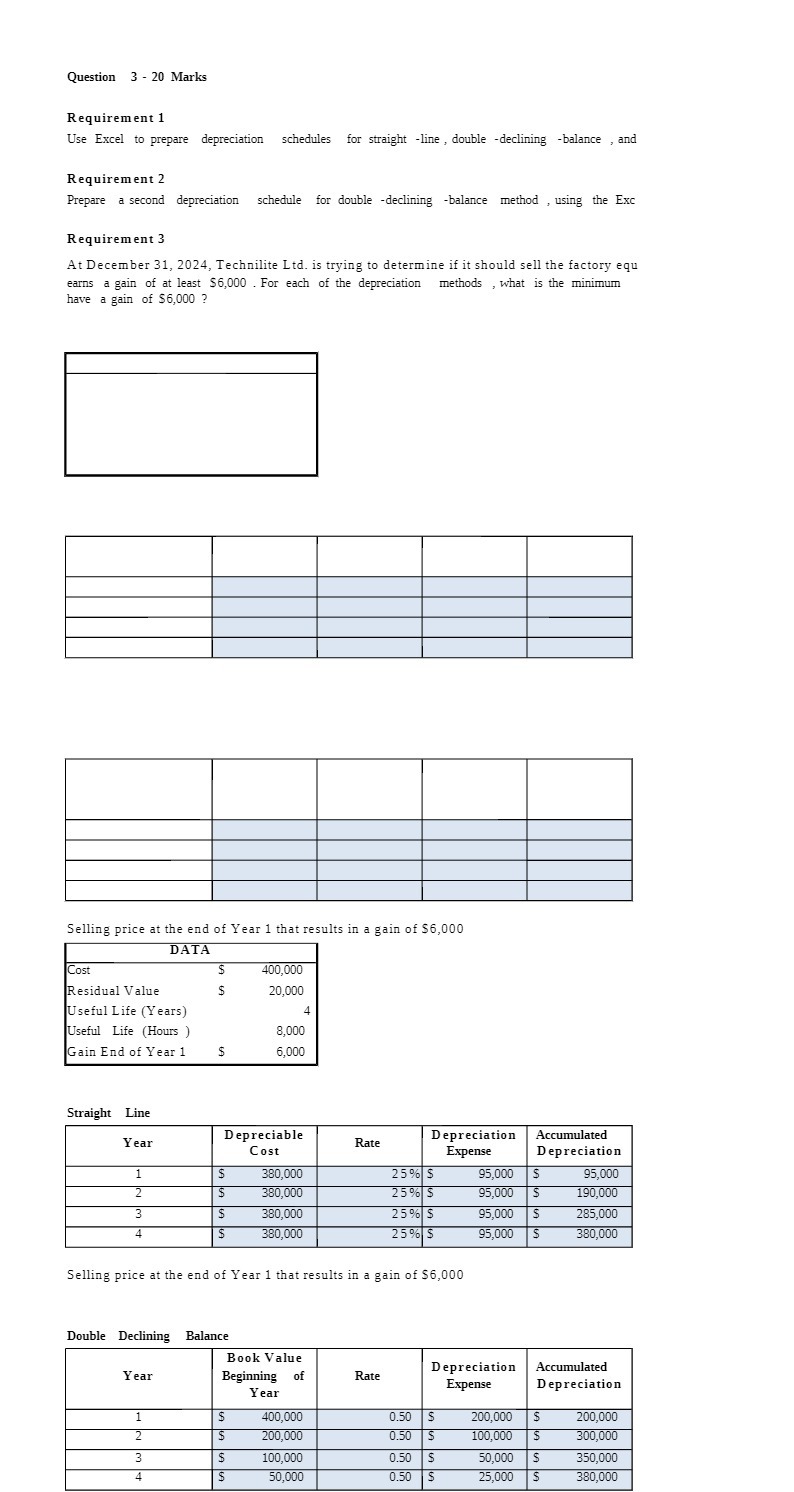

Question 3 - 20 Marks Requirement 1 Use Excel to prepare depreciation schedules for straight -line , double -declining -balance , and Requirement 2 Prepare a second depreciation schedule for double -declining -balance method , using the Exc Requirement 3 At December 31, 2024, Technilite Ltd. is trying to determine if it should sell the factory equ earns a gain of at least $6,000 . For each of the depreciation methods , what is the minimum have a gain of $6,000 ? Selling price at the end of Year 1 that results in a gain of $6,000 DATA Cost 400,000 Residual Value 20,000 Useful Life (Years) Useful Life (Hours ) 8,000 Gain End of Year 1 $ 6,000 Straight Line Year Depreciable Cost Rate Depreciation Accumulated Expense Depreciation 1 380,000 25% $ 95,000 S 95,000 380,000 25% $ 95,000 S 190,000 W N 380,000 25% $ 95,000 S 285,000 380,000 25% $ 95,000 S 380,000 Selling price at the end of Year 1 that results in a gain of $6,000 Double Declining Balance Book Value Year Depreciation Accumulated Beginning of Rate Year Expense Depreciation 400,000 0.50 S 200,000 200,000 200,000 0.50 100,000 300,000 100,000 0.50 50,000 350,000 50,000 0.50 25,000 $ 380,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts