Question: Question 3 (20 marks)-- URGENTLY NEEDED, PLEASE HELP ME SOLVE ASAP Gina has picked 2 stocks to invest in: Frontier Limited (Frontier) and Arrow Corp

Question 3 (20 marks)-- URGENTLY NEEDED, PLEASE HELP ME SOLVE ASAP

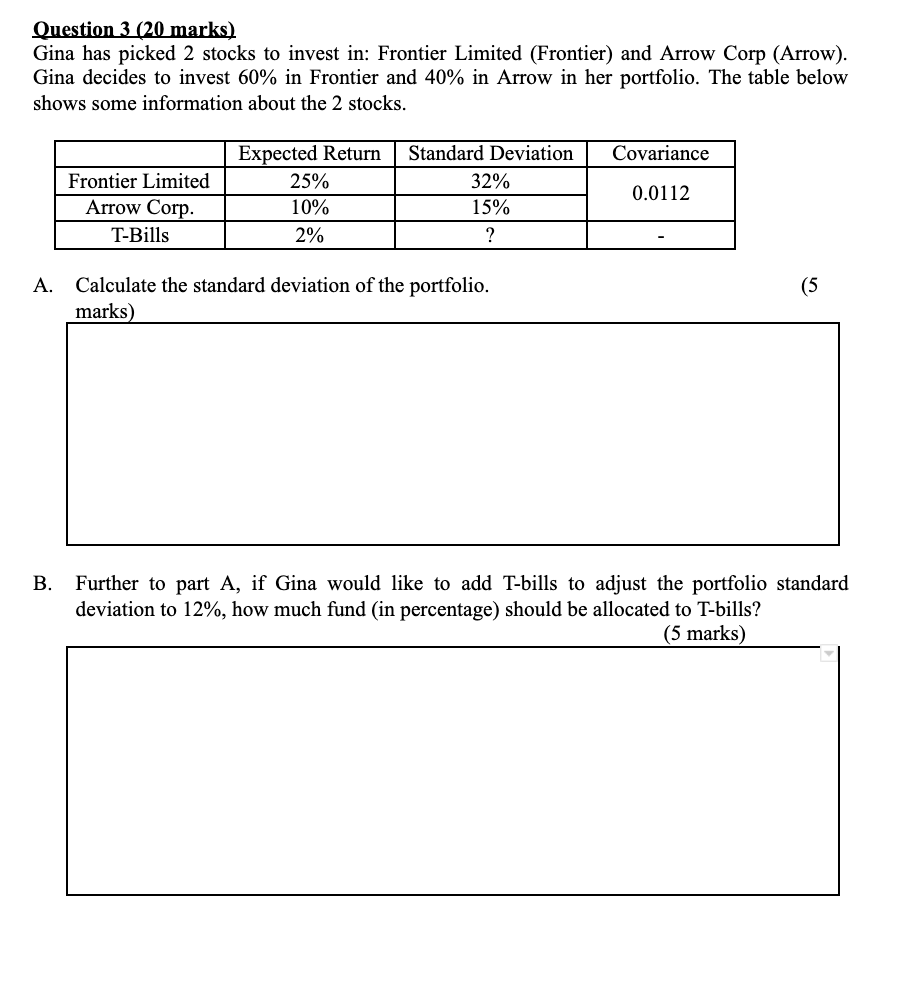

Gina has picked 2 stocks to invest in: Frontier Limited (Frontier) and Arrow Corp (Arrow). Gina decides to invest 60% in Frontier and 40% in Arrow in her portfolio. The table below shows some information about the 2 stocks.

| Expected Return | Standard Deviation | Covariance | |

| Frontier Limited | 25% | 32% | 0.0112 |

| Arrow Corp. | 10% | 15% | |

| T-Bills | 2% | ? | - |

-

Calculate the standard deviation of the portfolio. (5 marks)

-

Further to part A, if Gina would like to add T-bills to adjust the portfolio standard deviation to 12%, how much fund (in percentage) should be allocated to T-bills? (5 marks)

-

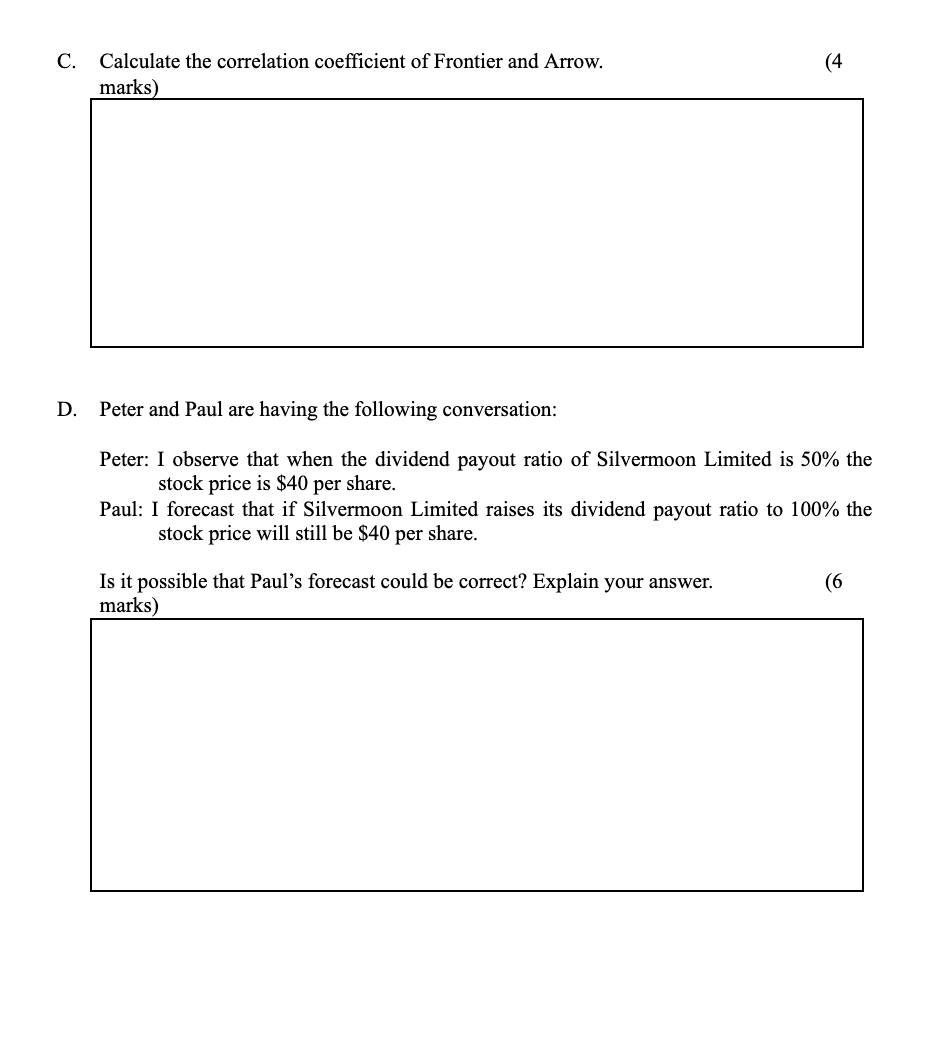

Calculate the correlation coefficient of Frontier and Arrow. (4 marks)

-

Peter and Paul are having the following conversation:

Peter: I observe that when the dividend payout ratio of Silvermoon Limited is 50% the stock price is $40 per share.

Paul: I forecast that if Silvermoon Limited raises its dividend payout ratio to 100% the stock price will still be $40 per share.

Is it possible that Pauls forecast could be correct? Explain your answer. (6 marks)

C. (4 Calculate the correlation coefficient of Frontier and Arrow. marks) D. Peter and Paul are having the following conversation: Peter: I observe that when the dividend payout ratio of Silvermoon Limited is 50% the stock price is $40 per share. Paul: I forecast that if Silvermoon Limited raises its dividend payout ratio to 100% the stock price will still be $40 per share. Is it possible that Paul's forecast could be correct? Explain your answer. marks) (6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts