Question: Z Plc is considering a project which will necessitate the acquisition of a new machine to neutralize the toxic waste produced by its refining

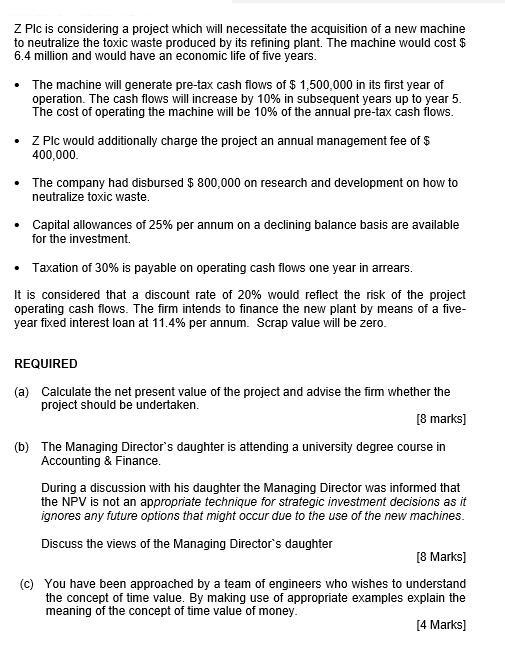

Z Plc is considering a project which will necessitate the acquisition of a new machine to neutralize the toxic waste produced by its refining plant. The machine would cost $ 6.4 million and would have an economic life of five years. The machine will generate pre-tax cash flows of $ 1,500,000 in its first year of operation. The cash flows will increase by 10% in subsequent years up to year 5. The cost of operating the machine will be 10% of the annual pre-tax cash flows. Z Plc would additionally charge the project an annual management fee of $ 400,000. The company had disbursed $ 800,000 on research and development on how to neutralize toxic waste. Capital allowances of 25% per annum on a declining balance basis are available for the investment. Taxation of 30% is payable on operating cash flows one year in arrears. It is considered that a discount rate of 20% would reflect the risk of the project operating cash flows. The firm intends to finance the new plant by means of a five- year fixed interest loan at 11.4% per annum. Scrap value will be zero. REQUIRED (a) Calculate the net present value of the project and advise the firm whether the project should be undertaken. [8 marks] (b) The Managing Director's daughter is attending a university degree course in Accounting & Finance. During a discussion with his daughter the Managing Director was informed that the NPV is not an appropriate technique for strategic investment decisions as it ignores any future options that might occur due to the use of the new machines. Discuss the views of the Managing Director's daughter [8 Marks] (c) You have been approached by a team of engineers who wishes to understand the concept of time value. By making use of appropriate examples explain the meaning of the concept of time value of money. [4 Marks]

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Machine cost 6400000 is relevant cost Research and development 800000 is irrelevant cost Calculation of the CFAT Year pretax cash flows of Operating c... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

60d5e1d22d23c_228353.pdf

180 KBs PDF File

60d5e1d22d23c_228353.docx

120 KBs Word File