Question: Question 3 (20 points) According to the financial statements for Samson Electronics, Inc., the firm has total assets valued at $310 million. It also has

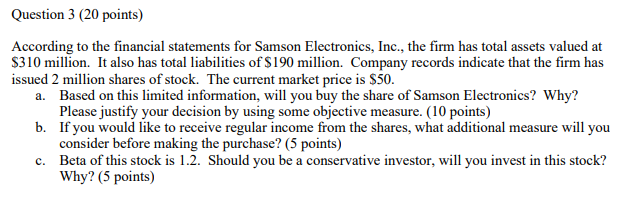

Question 3 (20 points) According to the financial statements for Samson Electronics, Inc., the firm has total assets valued at $310 million. It also has total liabilities of $190 million. Company records indicate that the firm has issued 2 million shares of stock. The current market price is $50. a. Based on this limited information, will you buy the share of Samson Electronics? Why? Please justify your decision by using some objective measure. (10 points) b. If you would like to receive regular income from the shares, what additional measure will you consider before making the purchase? (5 points) c. Beta of this stock is 1.2. Should you be a conservative investor, will you invest in this stock? Why? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts