Question: Question 3 (20 points) Please match the ratio with its explanation, or chose none of these. Each choice may be used more than once. Question

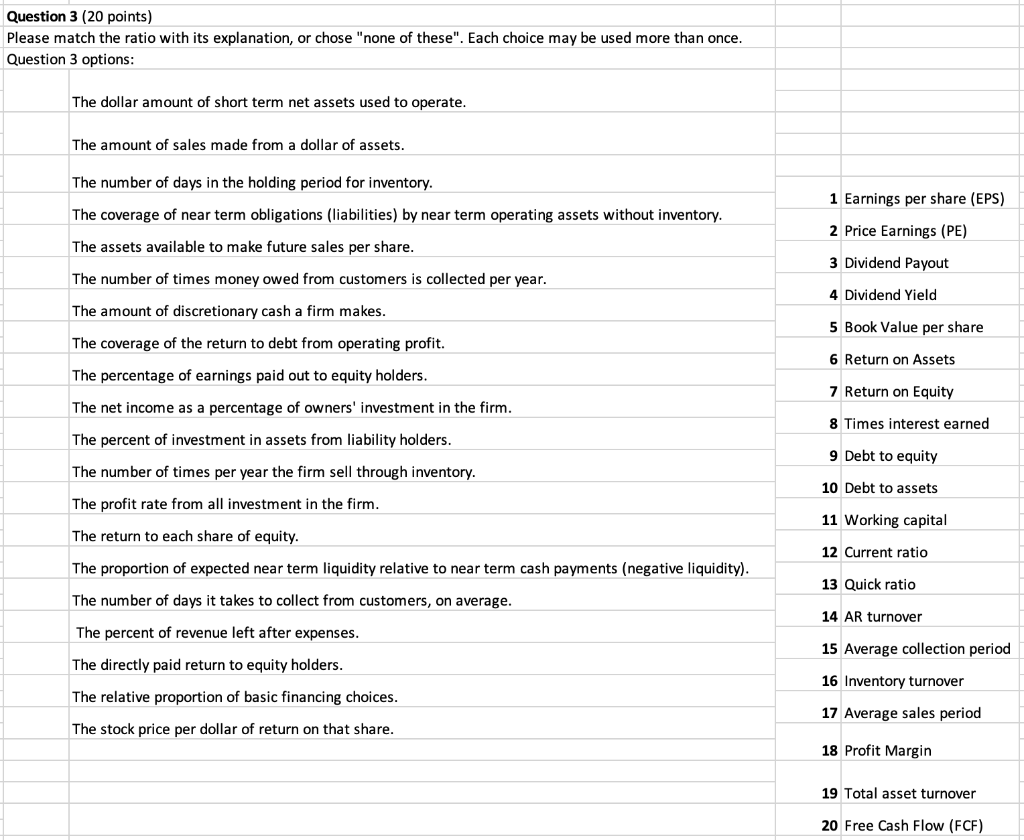

Question 3 (20 points) Please match the ratio with its explanation, or chose "none of these". Each choice may be used more than once. Question 3 options: The dollar amount of short term net assets used to operate. The amount of sales made from a dollar of assets. The number of days in the holding period for inventory. 1 Earnings per share (EPS) The coverage of near term obligations (liabilities) by near term operating assets without inventory. 2 Price Earnings (PE) The assets available to make future sales per share. 3 Dividend Payout 4 Dividend Yield The number of times money owed from customers is collected per year. The amount of discretionary cash a firm makes. The coverage of the return to debt from operating profit. The percentage of earnings paid out to equity holders. 5 Book Value per share 6 Return on Assets 7 Return on Equity The net income as a percentage of owners' investment in the firm. The percent of investment in assets from liability holders. 8 Times interest earned 9 Debt to equity The number of times per year the firm sell through inventory. 10 Debt to assets The profit rate from all investment in the firm. 11 Working capital The return to each share of equity. 12 Current ratio The proportion of expected near term liquidity relative to near term cash payments (negative liquidity). 13 Quick ratio The number of days it takes to collect from customers, on average. 14 AR turnover The percent of revenue left after expenses. 15 Average collection period The directly paid return to equity holders. 16 Inventory turnover The relative proportion of basic financing choices. 17 Average sales period The stock price per dollar of return on that share. 18 Profit Margin 19 Total asset turnover 20 Free Cash Flow (FCF)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts