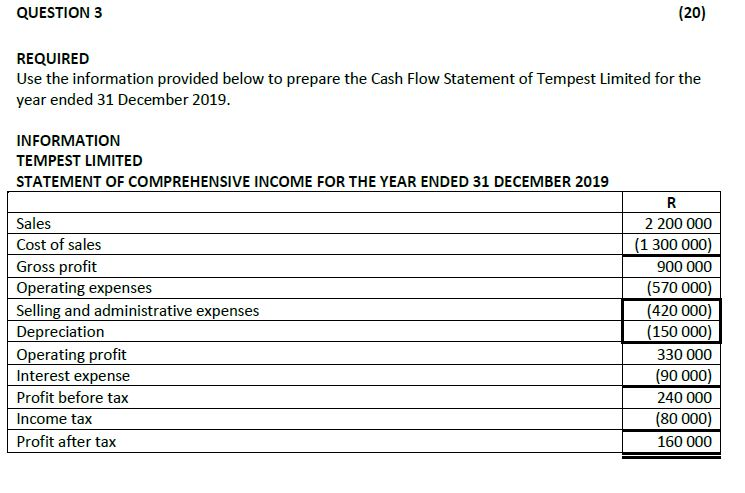

Question: QUESTION 3 (20) REQUIRED Use the information provided below to prepare the Cash Flow Statement of Tempest Limited for the year ended 31 December 2019.

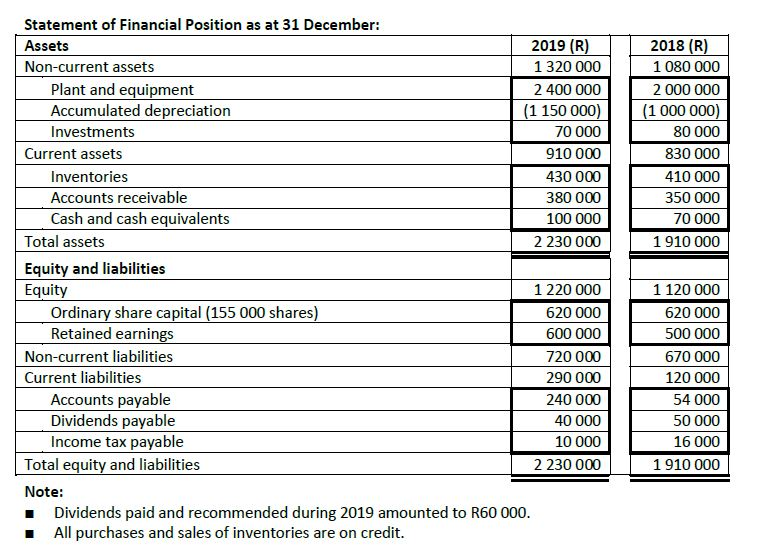

QUESTION 3 (20) REQUIRED Use the information provided below to prepare the Cash Flow Statement of Tempest Limited for the year ended 31 December 2019. INFORMATION TEMPEST LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2019 Sales Cost of sales Gross profit Operating expenses Selling and administrative expenses Depreciation Operating profit Interest expense Profit before tax Income tax Profit after tax 2 200 000 (1 300 000) 900 000 (570 000) (420 000) (150 000) 330 000 (90 000) 240 000 (80 000) 160 000 2018 (R) 1 080 000 2 000 000 (1 000 000) 80 000 830 000 410 000 350 000 70 000 1 910 000 Statement of Financial Position as at 31 December: Assets | 2019 (R) Non-current assets 1 320 000 Plant and equipment 2 400 000 Accumulated depreciation (1 150 000) Investments 70 000 Current assets 910 000 Inventories 430 000 Accounts receivable 380 000 Cash and cash equivalents 100 000 Total assets 2 230 000 Equity and liabilities Equity 1 220 000 Ordinary share capital (155 000 shares) 620 000 Retained earnings 600 000 Non-current liabilities 720 000 Current liabilities 290 000 Accounts payable 240 000 Dividends payable 40 000 Income tax payable 10 000 Total equity and liabilities 2 230 000 Note: Dividends paid and recommended during 2019 amounted to R60 000. All purchases and sales of inventories are on credit. 1 120 000 620 000 500 000 670 000 120 000 54 000 50 000 16 000 1 910 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts