Question: Question 3 ( 23 marks) Mandy is employed as a finance manager of Desmond Ltd (Desmond), a company carrying on business in Hong Kong. During

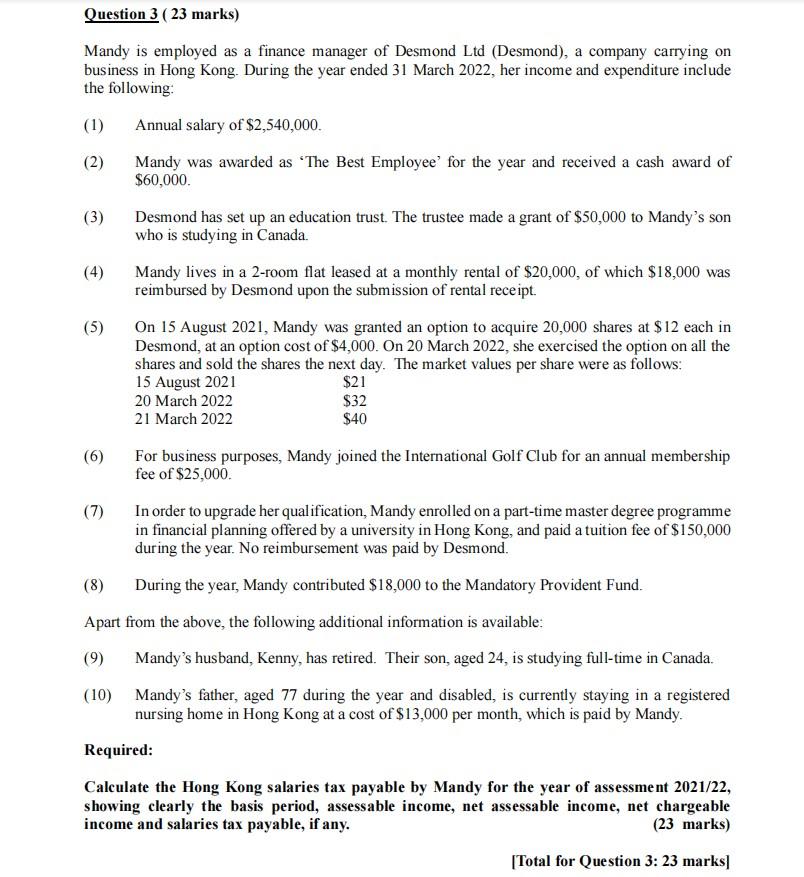

Question 3 ( 23 marks) Mandy is employed as a finance manager of Desmond Ltd (Desmond), a company carrying on business in Hong Kong. During the year ended 31 March 2022, her income and expenditure include the following: (1) Annual salary of $2,540,000. (2) Mandy was awarded as 'The Best Employee' for the year and received a cash award of $60,000. (3) Desmond has set up an education trust. The trustee made a grant of $50,000 to Mandy's son who is studying in Canada. (4) Mandy lives in a 2-room flat leased at a monthly rental of $20,000, of which $18,000 was reimbursed by Desmond upon the submission of rental receipt. (5) On 15 August 2021, Mandy was granted an option to acquire 20,000 shares at $12 each in Desmond, at an option cost of $4,000. On 20 March 2022 , she exercised the option on all the shares and sold the shares the next day. The market values per share were as follows: 15August202120March202221March2022$21$32$40 (6) For business purposes, Mandy joined the International Golf Club for an annual membership fee of $25,000. (7) In order to upgrade her qualification, Mandy enrolled on a part-time master degree programme in financial planning offered by a university in Hong Kong, and paid a tuition fee of $150,000 during the year. No reimbursement was paid by Desmond. (8) During the year, Mandy contributed $18,000 to the Mandatory Provident Fund. Apart from the above, the following additional information is available: (9) Mandy's husband, Kenny, has retired. Their son, aged 24, is studying full-time in Canada. (10) Mandy's father, aged 77 during the year and disabled, is currently staying in a registered nursing home in Hong Kong at a cost of $13,000 per month, which is paid by Mandy. Required: Calculate the Hong Kong salaries tax payable by Mandy for the year of assessment 2021/22, showing clearly the basis period, assessable income, net assessable income, net chargeable income and salaries tax payable, if any. (23 marks) [Total for Question 3: 23 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts