Question: Question 3 [23 marks Plato Electric Pte Ltd is a Maid Agency which was formed on 1 April 2007. For the year ended 31 July

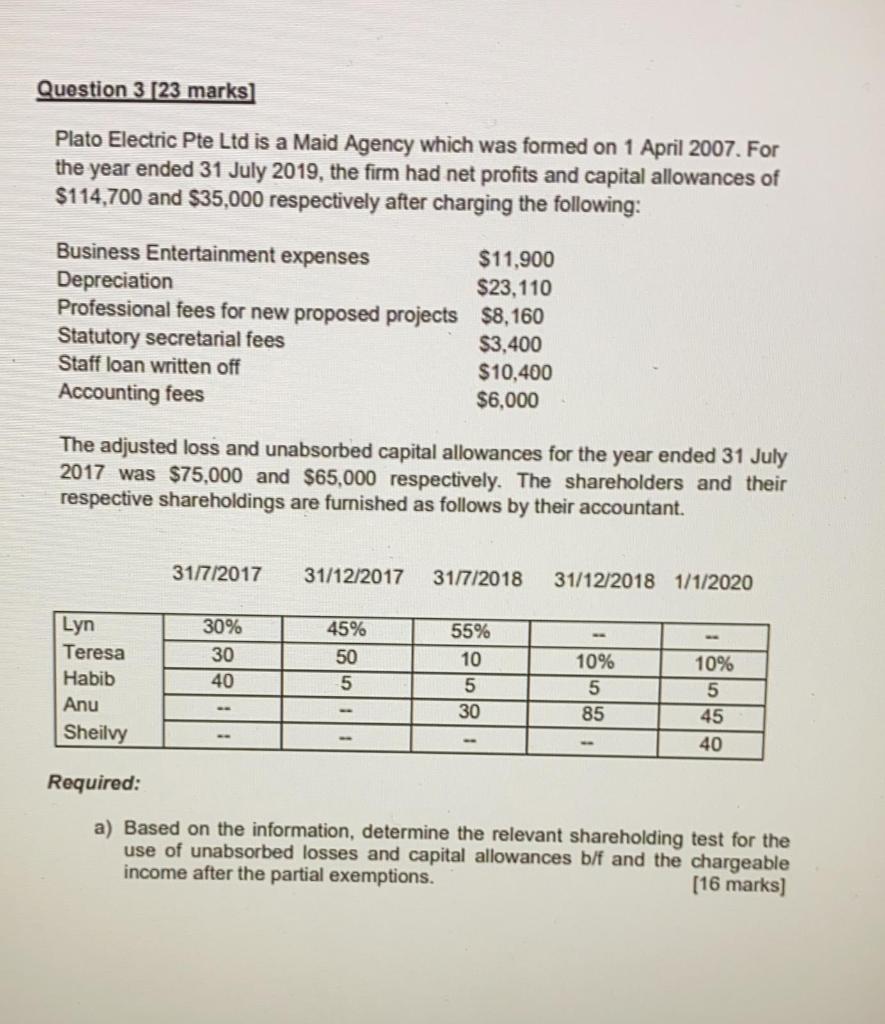

Question 3 [23 marks Plato Electric Pte Ltd is a Maid Agency which was formed on 1 April 2007. For the year ended 31 July 2019, the firm had net profits and capital allowances of $114,700 and $35,000 respectively after charging the following: Business Entertainment expenses $11,900 Depreciation $23, 110 Professional fees for new proposed projects $8,160 Statutory secretarial fees $3,400 Staff loan written off $10,400 Accounting fees $6,000 The adjusted loss and unabsorbed capital allowances for the year ended 31 July 2017 was $75,000 and $65,000 respectively. The shareholders and their respective shareholdings are furnished as follows by their accountant. 31/7/2017 31/12/2017 31/7/2018 31/12/2018 1/1/2020 Lyn Teresa Habib Anu Sheilvy 30% 30 40 45% 50 5 55% 10 5 30 10% 5 85 10% 5 45 40 Required: a) Based on the information, determine the relevant shareholding test for the use of unabsorbed losses and capital allowances b/f and the chargeable income after the partial exemptions. [16 marks] Question 3 [23 marks Plato Electric Pte Ltd is a Maid Agency which was formed on 1 April 2007. For the year ended 31 July 2019, the firm had net profits and capital allowances of $114,700 and $35,000 respectively after charging the following: Business Entertainment expenses $11,900 Depreciation $23, 110 Professional fees for new proposed projects $8,160 Statutory secretarial fees $3,400 Staff loan written off $10,400 Accounting fees $6,000 The adjusted loss and unabsorbed capital allowances for the year ended 31 July 2017 was $75,000 and $65,000 respectively. The shareholders and their respective shareholdings are furnished as follows by their accountant. 31/7/2017 31/12/2017 31/7/2018 31/12/2018 1/1/2020 Lyn Teresa Habib Anu Sheilvy 30% 30 40 45% 50 5 55% 10 5 30 10% 5 85 10% 5 45 40 Required: a) Based on the information, determine the relevant shareholding test for the use of unabsorbed losses and capital allowances b/f and the chargeable income after the partial exemptions. [16 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts