Question: Question 3 (24 points) Saved In the single-factor framework, the risk-free rate is ry=0.01 = 1% and the expected market risk premium is E(rm-r)=E(RM) =

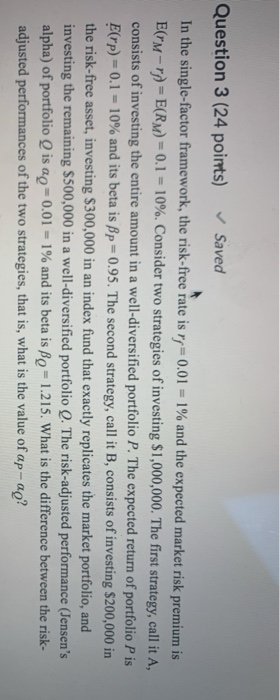

Question 3 (24 points) Saved In the single-factor framework, the risk-free rate is ry=0.01 = 1% and the expected market risk premium is E(rm-r)=E(RM) = 0.1 = 10%. Consider two strategies of investing $1,000,000. The first strategy, call it A, consists of investing the entire amount in a well-diversified portfolio P. The expected return of portfolio P is E(rp) - 0.1 = 10% and its beta is Bp=0.95. The second strategy, call it B, consists of investing $200,000 in the risk-free asset, investing $300,000 in an index fund that exactly replicates the market portfolio, and investing the remaining $500,000 in a well-diversified portfolio Q. The risk-adjusted performance (Jensen's alpha) of portfolio Q is ao -0.01 - 1% and its beta is Bo - 1.215. What is the difference between the risk- adjusted performances of the two strategies, that is, what is the value of ap-ao

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts