Question: QUESTION 3 (25 Marks) a. Gemerlang has in issue 500 000 RM1.00 ordinary shares whose current ex-dividend market price is RM1.50 per share. The company

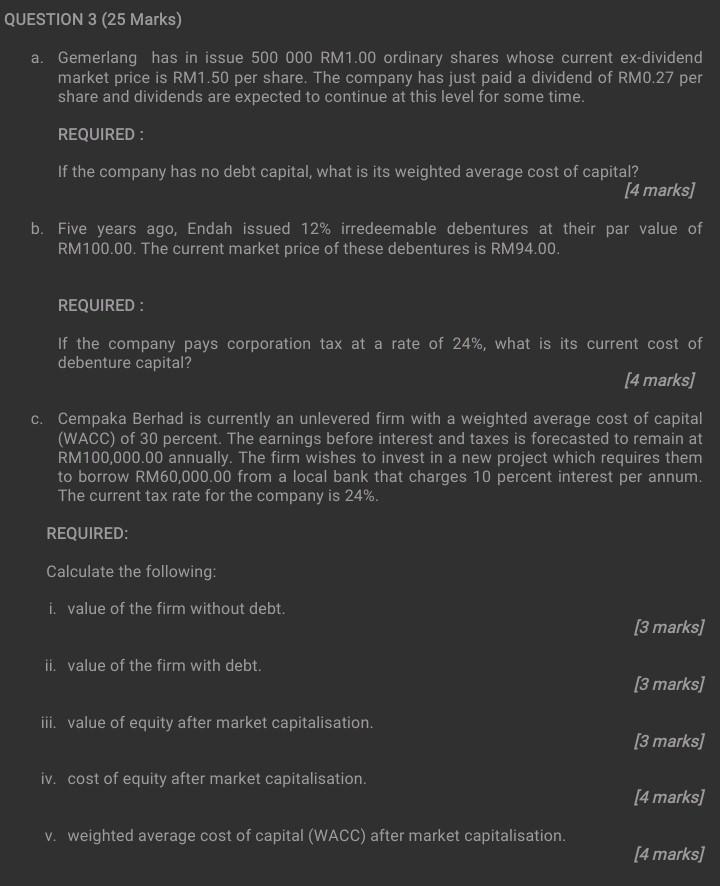

QUESTION 3 (25 Marks) a. Gemerlang has in issue 500 000 RM1.00 ordinary shares whose current ex-dividend market price is RM1.50 per share. The company has just paid a dividend of RM0.27 per share and dividends are expected to continue at this level for some time. REQUIRED: If the company has no debt capital, what is its weighted average cost of capital? [4 marks] b. Five years ago, Endah issued 12% irredeemable debentures at their par value of RM100.00. The current market price of these debentures is RM94.00. REQUIRED: If the company pays corporation tax at a rate of 24%, what is its current cost of debenture capital? (4 marks] C. Cempaka Berhad is currently an unlevered firm with a weighted average cost of capital (WACC) of 30 percent. The earnings before interest and taxes is forecasted to remain at RM100,000.00 annually. The firm wishes to invest in a new project which requires them to borrow RM60,000.00 from a local bank that charges 10 percent interest per annum. The current tax rate for the company is 24%. REQUIRED: Calculate the following: I. value of the firm without debt. [3 marks] li value of the firm with debt. [3 marks] iii. value of equity after market capitalisation [3 marks] iv. cost of equity after market capitalisation. [4 marks] V. weighted average cost of capital (WACC) after market capitalisation. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts