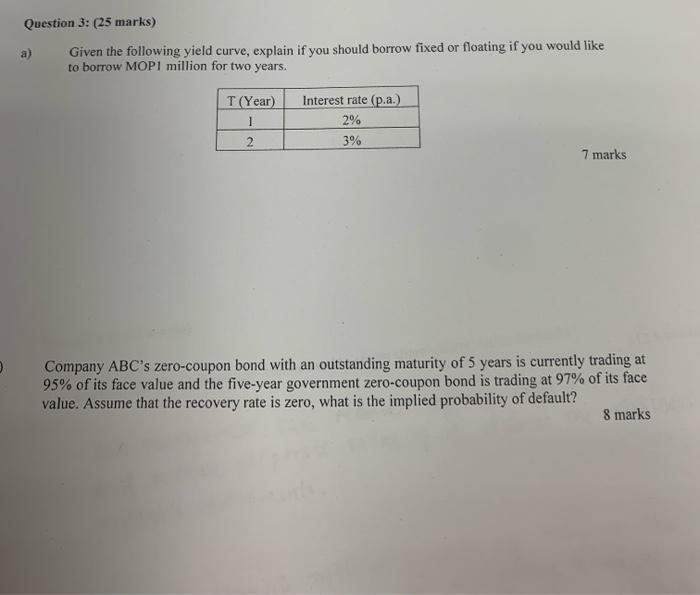

Question: Question 3: (25 marks) a) Given the following yield curve, explain if you should borrow fixed or floating if you would like to borrow MOP1

Question 3: (25 marks) a) Given the following yield curve, explain if you should borrow fixed or floating if you would like to borrow MOP1 million for two years. T (Year) 1 Interest rate (p.a.) 2% 2 3% 7 marks Company ABC's zero-coupon bond with an outstanding maturity of 5 years is currently trading at 95% of its face value and the five-year government zero-coupon bond is trading at 97% of its face value. Assume that the recovery rate is zero, what is the implied probability of default? 8 marks c) What is the implied probability of default if the recovery rate is 50% in b)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock