Question: Question 3 (25 marks) (a) Gold Metals Inc. has a 12% bond with semi-annual coupons that is currently trading at $1,586.39. The bond will mature

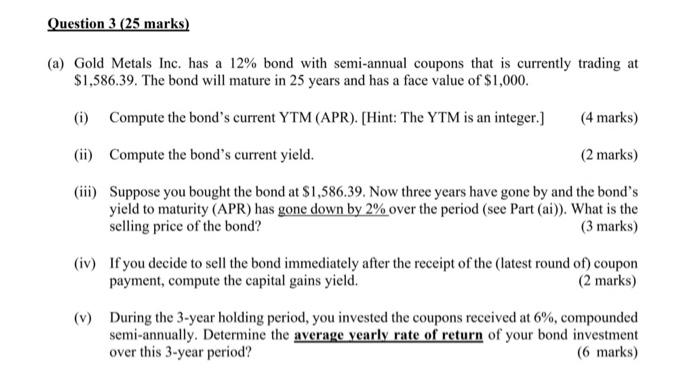

Question 3 (25 marks) (a) Gold Metals Inc. has a 12% bond with semi-annual coupons that is currently trading at $1,586.39. The bond will mature in 25 years and has a face value of $1,000. (1) Compute the bond's current YTM (APR). (Hint: The YTM is an integer.) (4 marks) (ii) Compute the bond's current yield. (2 marks) (iii) Suppose you bought the bond at $1,586.39. Now three years have gone by and the bond's yield to maturity (APR) has gone down by 2% over the period (see Part (ai)). What is the selling price of the bond? (3 marks) (iv) If you decide to sell the bond immediately after the receipt of the latest round of) coupon payment, compute the capital gains yield. (2 marks) (v) During the 3-year holding period, you invested the coupons received at 6%, compounded semi-annually. Determine the average yearly rate of return of your bond investment over this 3-year period? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts