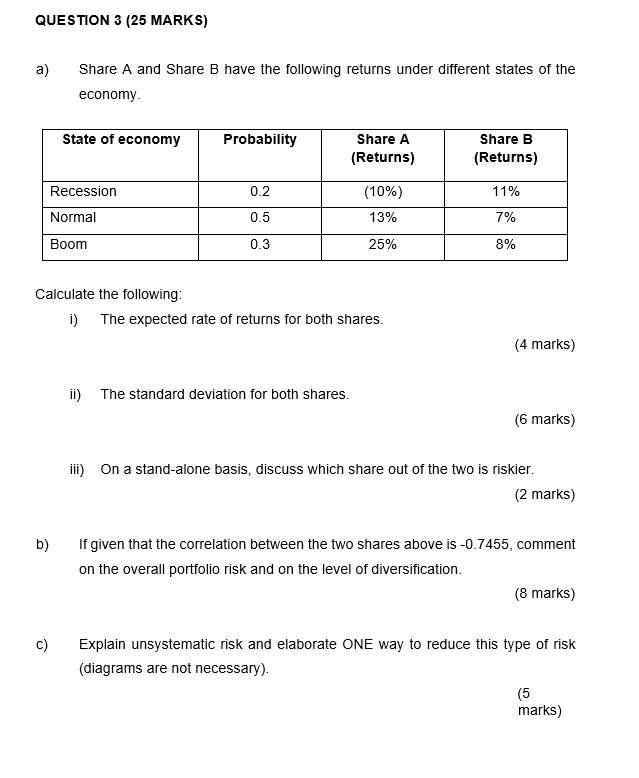

Question: QUESTION 3 (25 MARKS) a) Share A and Share B have the following returns under different states of the economy. Calculate the following: i) The

QUESTION 3 (25 MARKS) a) Share A and Share B have the following returns under different states of the economy. Calculate the following: i) The expected rate of returns for both shares. (4 marks) ii) The standard deviation for both shares. (6 marks) iii) On a stand-alone basis, discuss which share out of the two is riskier. (2 marks) b) If given that the correlation between the two shares above is 0.7455, comment on the overall portfolio risk and on the level of diversification. (8 marks) c) Explain unsystematic risk and elaborate ONE way to reduce this type of risk (diagrams are not necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts