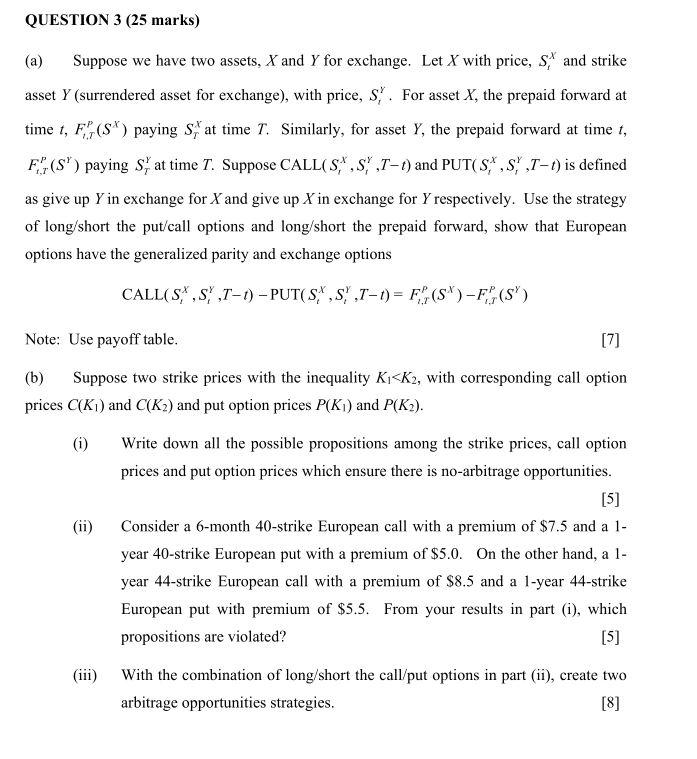

Question: QUESTION 3 (25 marks) (a) Suppose we have two assets, X and Y for exchange. Let X with price, s' and strike asset Y (surrendered

QUESTION 3 (25 marks) (a) Suppose we have two assets, X and Y for exchange. Let X with price, s' and strike asset Y (surrendered asset for exchange), with price, S,'. For asset X, the prepaid forward at time t, (s) paying S, at time T. Similarly, for asset Y, the prepaid forward at time t, F(S') paying at time T. Suppose CALL( 5,4,5,,1-1) and PUT(3,4,S,',1-1) is defined as give up Y in exchange for X and give up X in exchange for Y respectively. Use the strategy of long/short the put/call options and long/short the prepaid forward, show that European options have the generalized parity and exchange options CALL(S,',S,',1-1) - PUT(S,',S,',7-1)= F (S)-F (S) Note: Use payoff table. [7] (b) Suppose two strike prices with the inequality K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts