Question: QUESTION 3 (25 MARKS) (A) There are three steps involved in using Black Scholes model to calculate the option price, Briefly explain the steps. (3

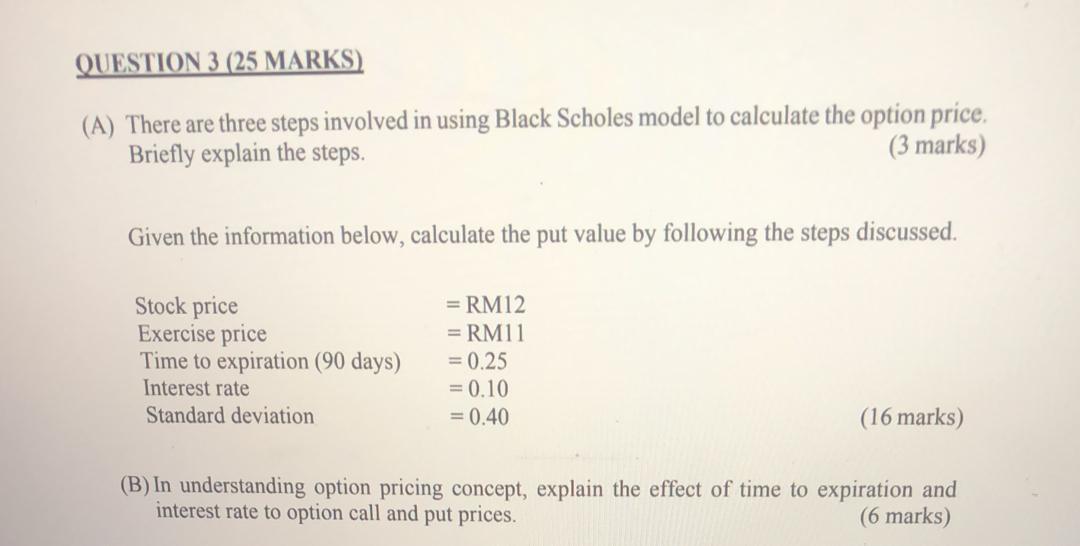

QUESTION 3 (25 MARKS) (A) There are three steps involved in using Black Scholes model to calculate the option price, Briefly explain the steps. (3 marks) Given the information below, calculate the put value by following the steps discussed. Stock price Exercise price Time to expiration (90 days) Interest rate Standard deviation = RM12 = RM11 = 0.25 = 0.10 = 0.40 (16 marks) (B) In understanding option pricing concept, explain the effect of time to expiration and interest rate to option call and put prices. (6 marks) QUESTION 3 (25 MARKS) (A) There are three steps involved in using Black Scholes model to calculate the option price, Briefly explain the steps. (3 marks) Given the information below, calculate the put value by following the steps discussed. Stock price Exercise price Time to expiration (90 days) Interest rate Standard deviation = RM12 = RM11 = 0.25 = 0.10 = 0.40 (16 marks) (B) In understanding option pricing concept, explain the effect of time to expiration and interest rate to option call and put prices. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts