Question: QUESTION 3 (25 Marks) Evaluate Kurt Lewins change process model and suggest a process that DaimlerChrysler can implement when leading organisational change. HU Change Sensational

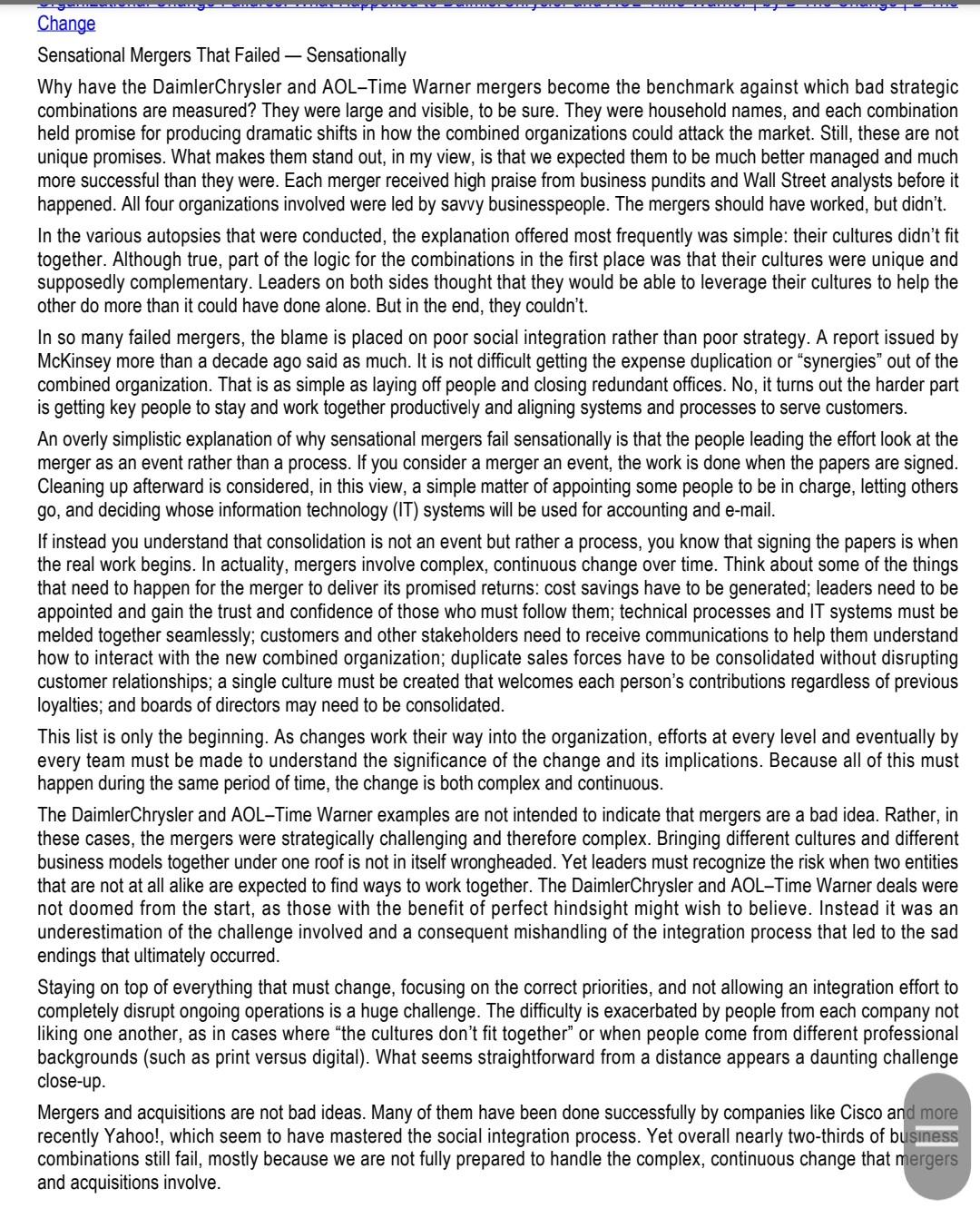

QUESTION 3 (25 Marks) Evaluate Kurt Lewins change process model and suggest a process that DaimlerChrysler can implement when leading organisational change. HU Change Sensational Mergers That Failed Sensationally Why have the DaimlerChrysler and AOL-Time Warner mergers become the benchmark against which bad strategic combinations are measured? They were large and visible, to be sure. They were household names, and each combination held promise for producing dramatic shifts in how the combined organizations could attack the market. Still, these are not unique promises. What makes them stand out, in my view, is that we expected them to be much better managed and much more successful than they were. Each merger received high praise from business pundits and Wall Street analysts before it happened. All four organizations involved were led by savvy businesspeople. The mergers should have worked, but didn't. In the various autopsies that were conducted, the explanation offered most frequently was simple: their cultures didn't fit together. Although true, part of the logic for the combinations in the first place was that their cultures were unique and supposedly complementary. Leaders on both sides thought that they would be able to leverage their cultures to help the other do more than it could have done alone. But in the end, they couldn't. In so many failed mergers, the blame is placed on poor social integration rather than poor strategy. A report issued by McKinsey more than a decade ago said as much. It is not difficult getting the expense duplication or "synergies" out of the combined organization. That is as simple as laying off people and closing redundant offices. No, it turns out the harder part is getting key people to stay and work together productively and aligning systems and processes to serve customers. An overly simplistic explanation of why sensational mergers fail sensationally is that the people leading the effort look at the merger as an event rather than a process. If you consider a merger an event, the work is done when the papers are signed. Cleaning up afterward is considered, in this view, a simple matter of appointing some people to be in charge, letting others go, and deciding whose information technology (IT) systems will be used for accounting and e-mail. If instead you understand that consolidation is not an event but rather a process, you know that signing the papers is when the real work begins. In actuality, mergers involve complex, continuous change over time. Think about some of the things that need to happen for the merger to deliver its promised returns: cost savings have to be generated; leaders need to be appointed and gain the trust and confidence of those who must follow them; technical processes and IT systems must be melded together seamlessly; customers and other stakeholders need to receive communications to help them understand how to interact with the new combined organization; duplicate sales forces have to be consolidated without disrupting customer relationships; a single culture must be created that welcomes each person's contributions regardless of previous loyalties; and boards of directors may need to be consolidated. This list is only the beginning. As changes work their way into the organization, efforts at every level and eventually by every team must be made to understand the significance of the change and its implications. Because all of this must happen during the same period of time, the change is both complex and continuous. The DaimlerChrysler and AOL-Time Warner examples are not intended to indicate that mergers are a bad idea. Rather, in these cases, the mergers were strategically challenging and therefore complex. Bringing different cultures and different business models together under one roof is not in itself wrongheaded. Yet leaders must recognize the risk when two entities that are not at all alike are expected to find ways to work together. The DaimlerChrysler and AOL-Time Warner deals were not doomed from the start, as those with the benefit of perfect hindsight might wish to believe. Instead it was an underestimation of the challenge involved and a consequent mishandling of the integration process that led to the sad endings that ultimately occurred. Staying on top of everything that must change, focusing on the correct priorities, and not allowing an integration effort to completely disrupt ongoing operations is a huge challenge. The difficulty is exacerbated by people from each company not liking one another, as in cases where the cultures don't fit together" or when people come from different professional backgrounds (such as print versus digital). What seems straightforward from a distance appears a daunting challenge close-up. Mergers and acquisitions are not bad ideas. Many of them have been done successfully by companies like Cisco and more recently Yahoo!, which seem to have mastered the social integration process. Yet overall nearly two-thirds of business combinations still fail, mostly because we are not fully prepared to handle the complex, continuous change that mergers and acquisitions involve

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock