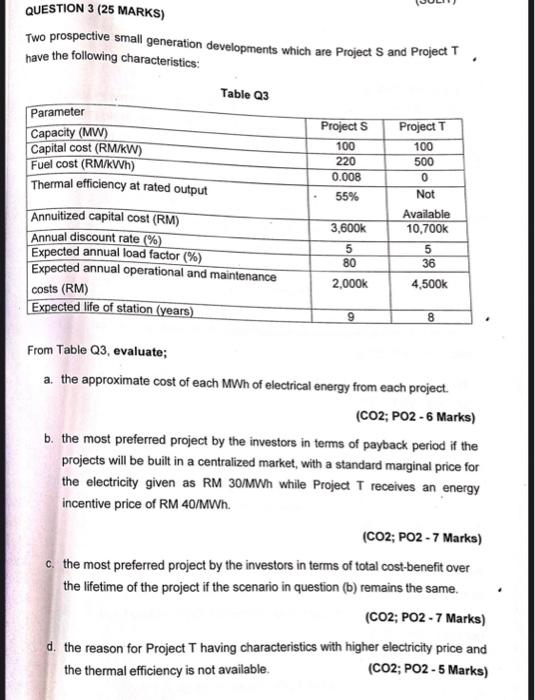

Question: QUESTION 3 (25 MARKS) Two prospective small generation developments which are Project S and Project T have the following characteristics: Table 23 Parameter Projects Project

QUESTION 3 (25 MARKS) Two prospective small generation developments which are Project S and Project T have the following characteristics: Table 23 Parameter Projects Project T Capacity (MW) Capital cost (RM/KW) Fuel cost (RM/KWh) Thermal efficiency at rated output Annuitized capital cost (RM) Available 3,600K 10,700k Annual discount rate (%) Expected annual load factor (%) Expected annual operational and maintenance 2,000k 4,500k costs (RM) Expected life of station (years) 100 220 0.008 55% 100 500 0 Not 5 80 5 36 8 From Table Q3, evaluate; a the approximate cost of each MWh of electrical energy from each project. (CO2; PO2 - 6 Marks) b. the most preferred project by the investors in terms of payback period if the projects will be built in a centralized market, with a standard marginal price for the electricity given as RM 30/MWh while Project T receives an energy incentive price of RM 40/MWh. (CO2: PO2 - 7 Marks) c. the most preferred project by the investors in terms of total cost-benefit over the lifetime of the project if the scenario in question (b) remains the same. (CO2; PO2 - 7 Marks) d. the reason for Project T having characteristics with higher electricity price and the thermal efficiency is not available. (CO2; PO2 - 5 Marks) QUESTION 3 (25 MARKS) Two prospective small generation developments which are Project S and Project T have the following characteristics: Table 23 Parameter Projects Project T Capacity (MW) Capital cost (RM/KW) Fuel cost (RM/KWh) Thermal efficiency at rated output Annuitized capital cost (RM) Available 3,600K 10,700k Annual discount rate (%) Expected annual load factor (%) Expected annual operational and maintenance 2,000k 4,500k costs (RM) Expected life of station (years) 100 220 0.008 55% 100 500 0 Not 5 80 5 36 8 From Table Q3, evaluate; a the approximate cost of each MWh of electrical energy from each project. (CO2; PO2 - 6 Marks) b. the most preferred project by the investors in terms of payback period if the projects will be built in a centralized market, with a standard marginal price for the electricity given as RM 30/MWh while Project T receives an energy incentive price of RM 40/MWh. (CO2: PO2 - 7 Marks) c. the most preferred project by the investors in terms of total cost-benefit over the lifetime of the project if the scenario in question (b) remains the same. (CO2; PO2 - 7 Marks) d. the reason for Project T having characteristics with higher electricity price and the thermal efficiency is not available. (CO2; PO2 - 5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts