Question: Question 3 25 points Save Answer (25 points) You can obtain a loan with a face value of $100,000 at a coupon rate of 10

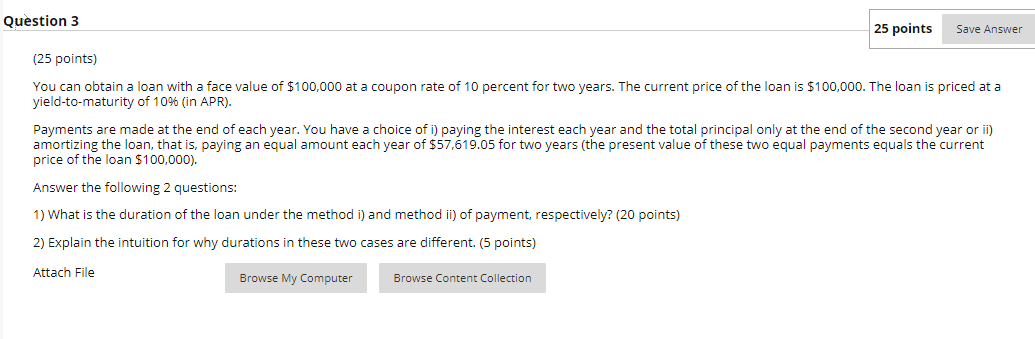

Question 3 25 points Save Answer (25 points) You can obtain a loan with a face value of $100,000 at a coupon rate of 10 percent for two years. The current price of the loan is $100,000. The loan is priced at a yield-to-maturity of 10% (in APR). Payments are made at the end of each year. You have a choice of i) paying the interest each year and the total principal only at the end of the second year or ii) amortizing the loan, that is, paying an equal amount each year of $57,619.05 for two years (the present value of these two equal payments equals the current price of the loan $100,000). Answer the following 2 questions: 1) What is the duration of the loan under the method i) and method ii) of payment, respectively? (20 points) 2) Explain the intuition for why durations in these two cases are different. (5 points) Attach File Browse My Computer Browse Content Collection Question 3 25 points Save Answer (25 points) You can obtain a loan with a face value of $100,000 at a coupon rate of 10 percent for two years. The current price of the loan is $100,000. The loan is priced at a yield-to-maturity of 10% (in APR). Payments are made at the end of each year. You have a choice of i) paying the interest each year and the total principal only at the end of the second year or ii) amortizing the loan, that is, paying an equal amount each year of $57,619.05 for two years (the present value of these two equal payments equals the current price of the loan $100,000). Answer the following 2 questions: 1) What is the duration of the loan under the method i) and method ii) of payment, respectively? (20 points) 2) Explain the intuition for why durations in these two cases are different. (5 points) Attach File Browse My Computer Browse Content Collection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts