Question: Question 3 25 pts (CHAPTER 17) DEBT In one year: Firm XYZ will earn $110 if its businesses perform well. The Firm owes a $60

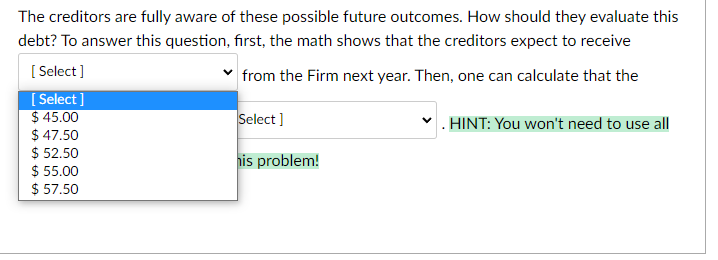

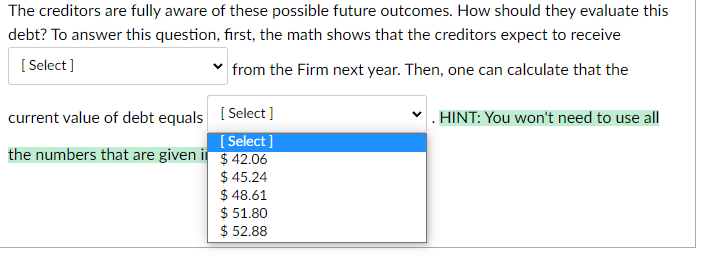

Question 3 25 pts (CHAPTER 17) DEBT In one year: Firm XYZ will earn $110 if its businesses perform well. The Firm owes a $60 payment to its creditors in one year. If the Firm's businesses perform poorly next year, then its earnings will only be $90. In this case, its payment to the creditors will be $50 because of the direct costs of bankruptcy. The chance that the Firm's businesses will perform well or poorly in one year equals 50%. The interest rate on the Firm's debt is 4%. The creditors are fully aware of these possible future outcomes. How should they evaluate this debt? To answer this question, first, the math shows that the creditors expect to receive [Select] from the Firm next year. Then, one can calculate that the current value of debt equals (Select] . HINT: You won't need to use all the numbers that are given in this problem! The creditors are fully aware of these possible future outcomes. How should they evaluate this debt? To answer this question, first, the math shows that the creditors expect to receive [Select] from the Firm next year. Then, one can calculate that the [Select] $ 45.00 Select ] HINT: You won't need to use all $ 47.50 $ 52.50 his problem! $ 55.00 $ 57.50 The creditors are fully aware of these possible future outcomes. How should they evaluate this debt? To answer this question, first, the math shows that the creditors expect to receive [ Select] from the Firm next year. Then, one can calculate that the HINT: You won't need to use all current value of debt equals (Select] [ Select ] the numbers that are given i $ 42.06 $ 45.24 $ 48.61 $ 51.80 $ 52.88 Question 3 25 pts (CHAPTER 17) DEBT In one year: Firm XYZ will earn $110 if its businesses perform well. The Firm owes a $60 payment to its creditors in one year. If the Firm's businesses perform poorly next year, then its earnings will only be $90. In this case, its payment to the creditors will be $50 because of the direct costs of bankruptcy. The chance that the Firm's businesses will perform well or poorly in one year equals 50%. The interest rate on the Firm's debt is 4%. The creditors are fully aware of these possible future outcomes. How should they evaluate this debt? To answer this question, first, the math shows that the creditors expect to receive [Select] from the Firm next year. Then, one can calculate that the current value of debt equals (Select] . HINT: You won't need to use all the numbers that are given in this problem! The creditors are fully aware of these possible future outcomes. How should they evaluate this debt? To answer this question, first, the math shows that the creditors expect to receive [Select] from the Firm next year. Then, one can calculate that the [Select] $ 45.00 Select ] HINT: You won't need to use all $ 47.50 $ 52.50 his problem! $ 55.00 $ 57.50 The creditors are fully aware of these possible future outcomes. How should they evaluate this debt? To answer this question, first, the math shows that the creditors expect to receive [ Select] from the Firm next year. Then, one can calculate that the HINT: You won't need to use all current value of debt equals (Select] [ Select ] the numbers that are given i $ 42.06 $ 45.24 $ 48.61 $ 51.80 $ 52.88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts