Question: Question 3 ( 3 0 marks ) Board Gear Corp. ( BG ) is considering manufacturing a new model of paddleboard. This project would require

Question marks

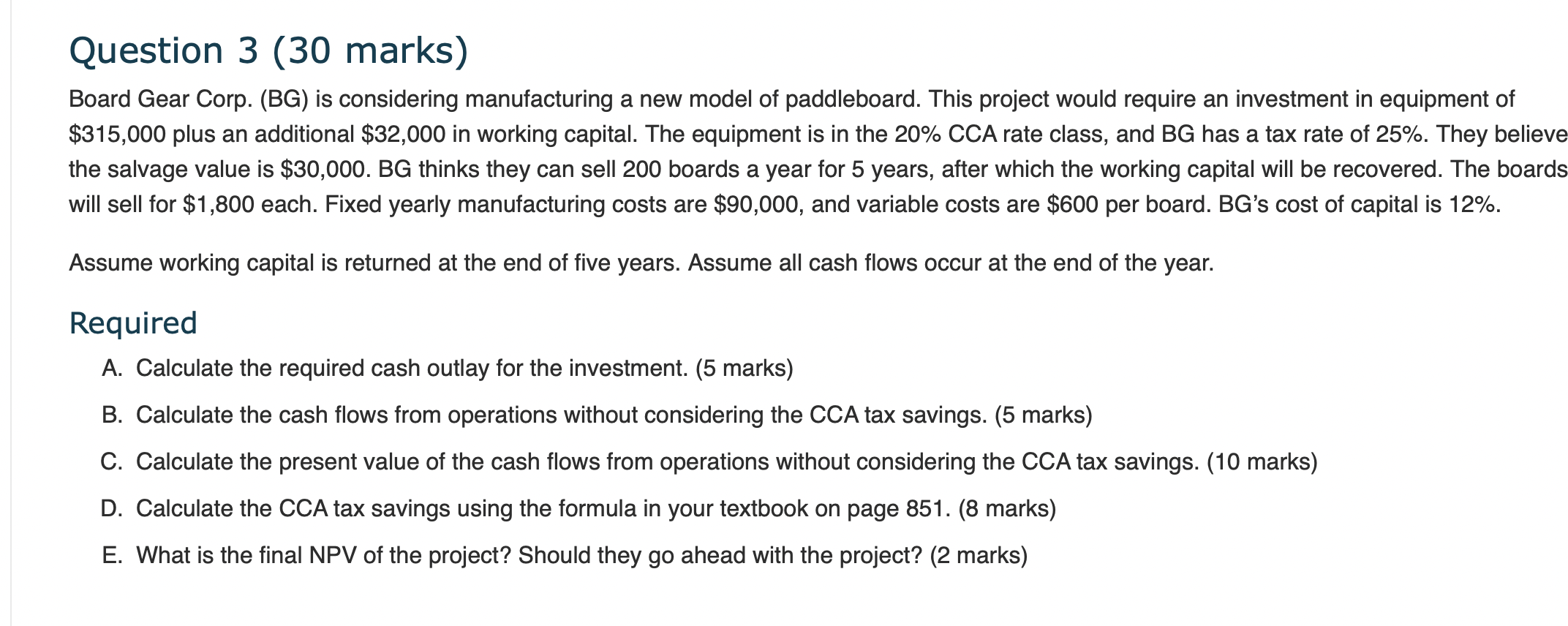

Board Gear Corp. BG is considering manufacturing a new model of paddleboard. This project would require an investment in equipment of $ plus an additional $ in working capital. The equipment is in the CCA rate class, and BG has a tax rate of They believe the salvage value is $ BG thinks they can sell boards a year for years, after which the working capital will be recovered. The boards will sell for $ each. Fixed yearly manufacturing costs are $ and variable costs are $ per board. BGs cost of capital is

Assume working capital is returned at the end of five years. Assume all cash flows occur at the end of the year.

Required

A Calculate the required cash outlay for the investment. marks

B Calculate the cash flows from operations without considering the CCA tax savings. marks

C Calculate the present value of the cash flows from operations without considering the CCA tax savings. marks

D Calculate the CCA tax savings using the formula in your textbook on page marks

E What is the final NPV of the project? Should they go ahead with the project? marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock