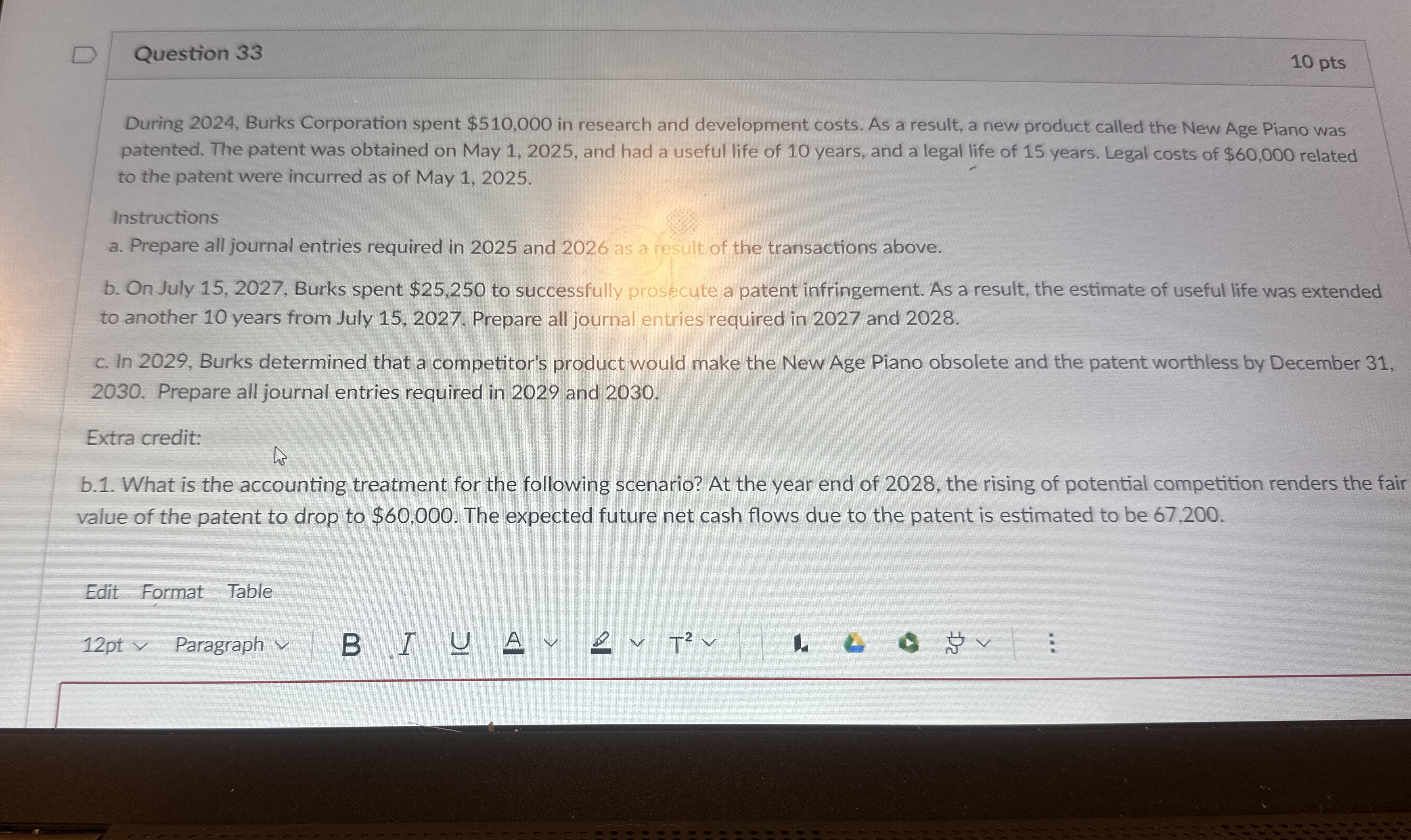

Question: Question 3 3 1 0 pts During 2 0 2 4 , Burks Corporation spent $ 5 1 0 , 0 0 0 in research

Question

pts

During Burks Corporation spent $ in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on May and had a useful life of years, and a legal life of years. Legal costs of $ related to the patent were incurred as of May

Instructions

a Prepare all journal entries required in and as a result of the transactions above.

b On July Burks spent $ to successfully prosecute a patent infringement. As a result, the estimate of useful life was extended to another years from July Prepare all journal entries required in and

c In Burks determined that a competitor's product would make the New Age Piano obsolete and the patent worthless by December Prepare all journal entries required in and

Extra credit:

b What is the accounting treatment for the following scenario? At the year end of the rising of potential competition renders the fair value of the patent to drop to $ The expected future net cash flows due to the patent is estimated to be

Edit Format Table

Question

pts

During Burks Corporation spent $ in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on May and had a useful life of years, and a legal life of years. Legal costs of $ related to the patent were incurred as of May

Instructions

a Prepare all journal entries required in and as a result of the transactions above.

b On July Burks spent $ to successfully prosecute a patent infringement. As a result, the estimate of useful life was extended to another years from July Prepare all journal entries required in and

c In Burks determined that a competitor's product would make the New Age Piano obsolete and the patent worthless by December Prepare all journal entries required in and

Extra credit:

b What is the accounting treatment for the following scenario? At the year end of the rising of potential competition renders the fair value of the patent to drop to $ The expected future net cash flows due to the patent is estimated to be

Edit Format Table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock