Question: Question 3 3 ( 1 point ) Ginny is a director of a company in Alberta and is paid director's fees of $ 3 ,

Question point

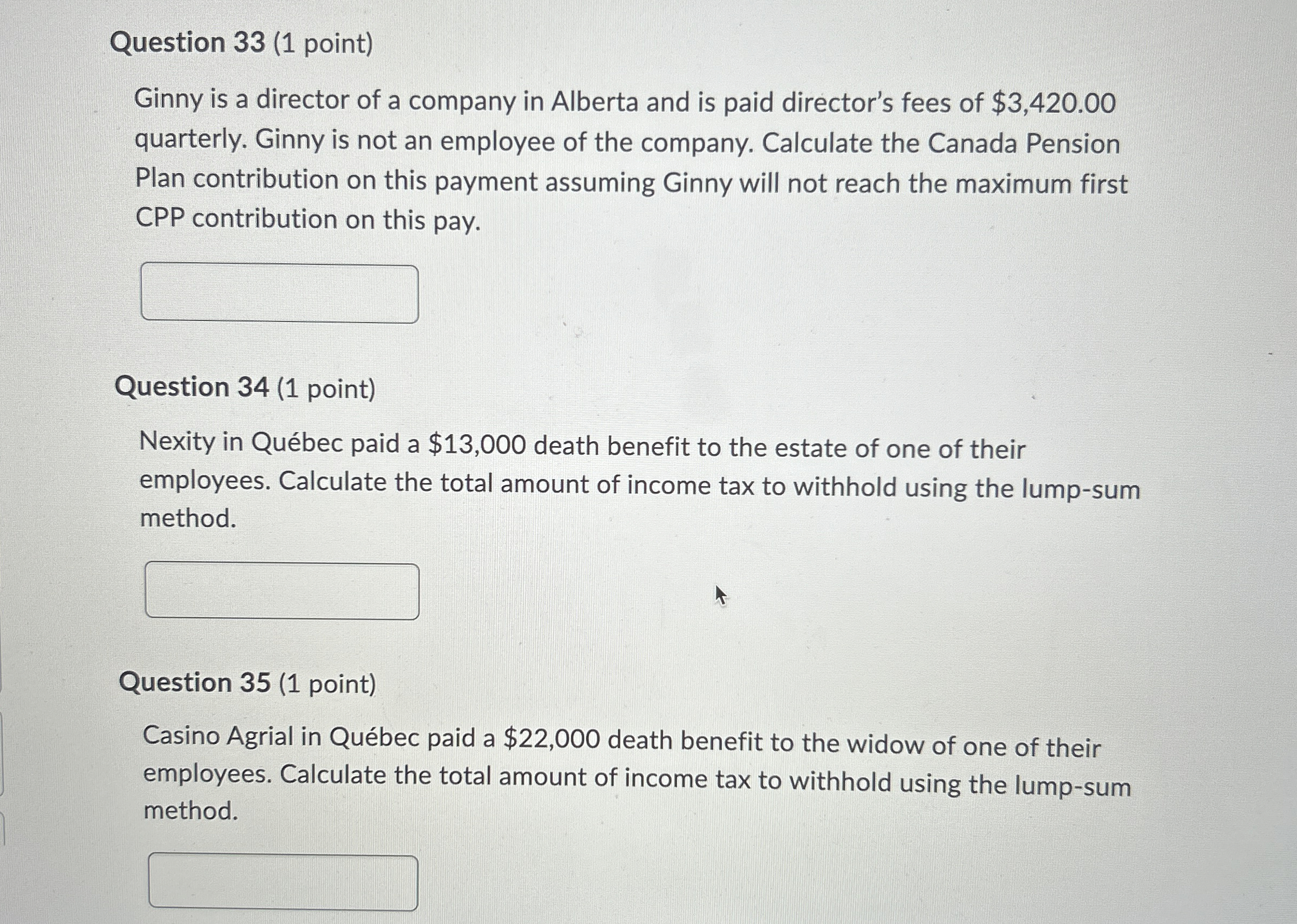

Ginny is a director of a company in Alberta and is paid director's fees of $ quarterly. Ginny is not an employee of the company. Calculate the Canada Pension Plan contribution on this payment assuming Ginny will not reach the maximum first CPP contribution on this pay.

Question point

Nexity in Qubec paid a $ death benefit to the estate of one of their employees. Calculate the total amount of income tax to withhold using the lumpsum method.

Question point

Casino Agrial in Qubec paid a $ death benefit to the widow of one of their employees. Calculate the total amount of income tax to withhold using the lumpsum method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock