Question: QUESTION 3 ( 3 5 Marks ) Charity te Water a 5 4 - year - old farmer recently won the best farmer award in

QUESTION Marks

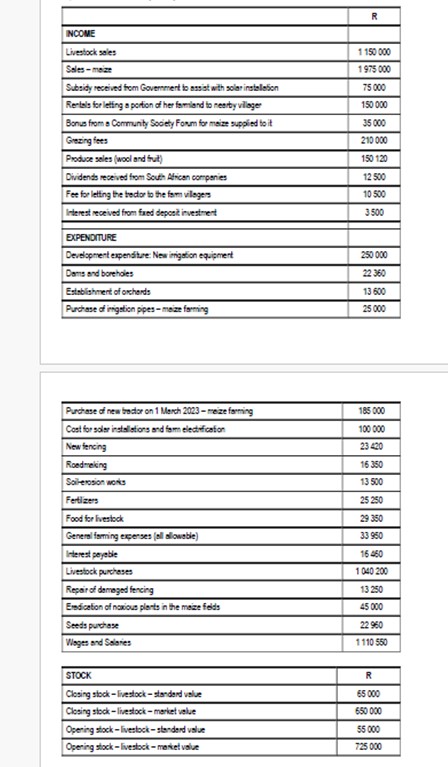

Charity te Water a yearold farmer recently won the best farmer award in the Free State Province. His farm business includes a range of livestock and maize. The following are the receipts, accruals and expenditure for his February year of assessment.

Use the provided table attached.

Notes:

Charity te Water slaughtered four cows for her domestic consumption and five cows as rations for her employees. She donated two cows to the farm local church. The standard vale of a cow is R its cost prices is R and its market value is R Charity te Water inherited livestock from an uncle during March The market value of this livestock was R Its standard value is R

During the current year his family consumed produce with an estimated cost of R

Charity te Water is not a member of a medical scheme. Qualifying medical expenses paid by her in the year of assessment amounted to R

YOU ARE REQUIRED TO calculate the taxable income of the farmer for the year of assessment ended February Use South Africa Tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock