Question: Question 3 3 points Save Answer Supercool Inc is currently an unlevered firm with 1,000 shares outstanding. It expects to generate $1,600 in EBIT in

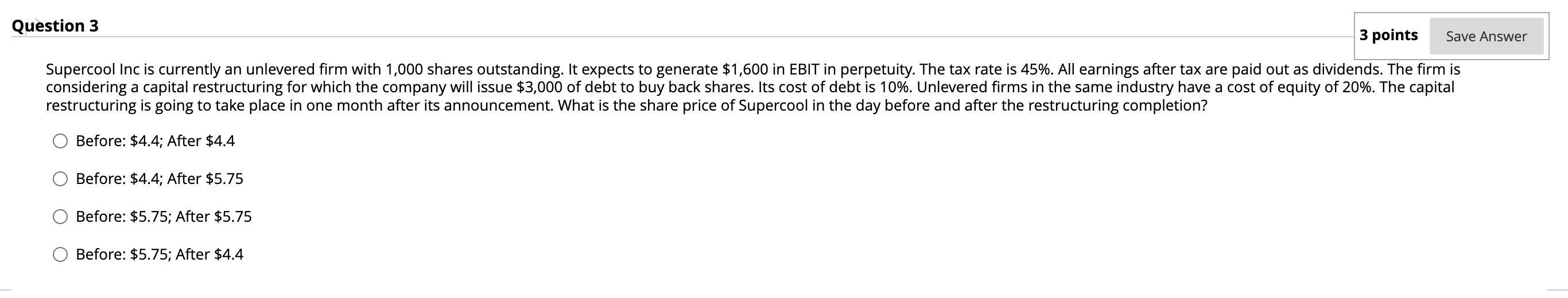

Question 3 3 points Save Answer Supercool Inc is currently an unlevered firm with 1,000 shares outstanding. It expects to generate $1,600 in EBIT in perpetuity. The tax rate is 45%. All earnings after tax are paid out as dividends. The firm is considering a capital restructuring for which the company will issue $3,000 of debt to buy back shares. Its cost of debt is 10%. Unlevered firms in the same industry have a cost of equity of 20%. The capital restructuring is going to take place in one month after its announcement. What is the share price of Supercool in the day before and after the restructuring completion? Before: $4.4; After $4.4 Before: $4.4; After $5.75 Before: $5.75; After $5.75 Before: $5.75; After $4.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts