Question: Question 3 3 pts Consider a 20-year 4.4% coupon bond with $ 1,000 par selling for $1079 (semi-annual coupons). Suppose that the first par call

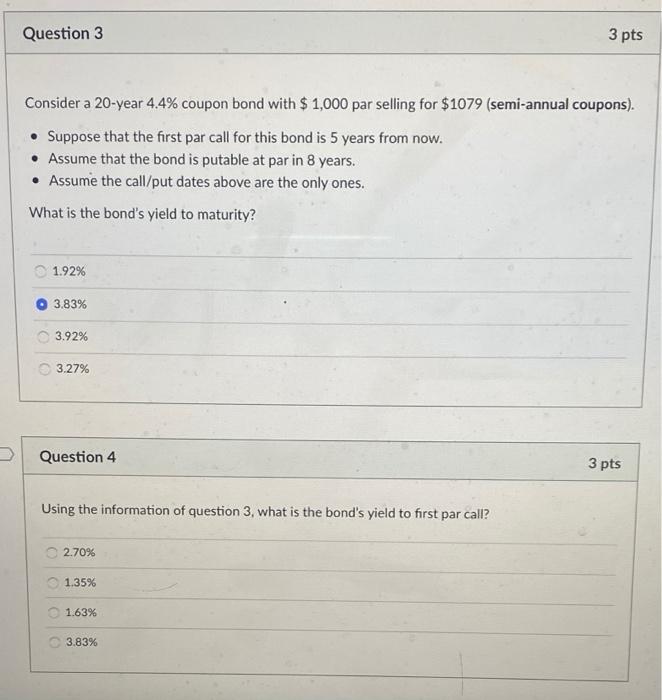

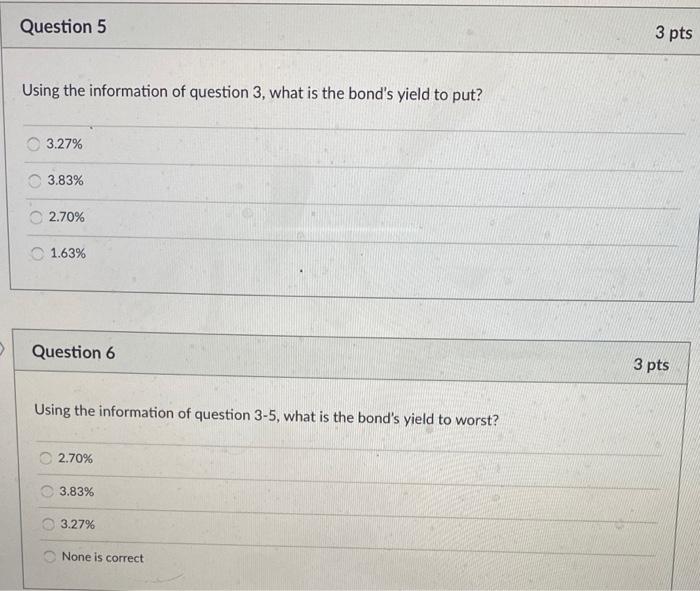

Question 3 3 pts Consider a 20-year 4.4% coupon bond with $ 1,000 par selling for $1079 (semi-annual coupons). Suppose that the first par call for this bond is 5 years from now. Assume that the bond is putable at par in 8 years. Assume the call/put dates above are the only ones. What is the bond's yield to maturity? 1.92% 3.83% 3.92% 3.27% Question 4 3 pts Using the information of question 3, what is the bond's yield to first par call? 2.70% 1.35% 1.63% 3.83% Question 5 3 pts Using the information of question 3, what is the bond's yield to put? 3.27% 3.83% 2.70% 1.63% Question 6 3 pts Using the information of question 3-5, what is the bond's yield to worst? 2.70% 3.83% 3.27% None is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts