Question: Question 3 3 pts If a firm has return on new investment opportunities of 15%, they plowback 15% of earnings on investments (that is, retention

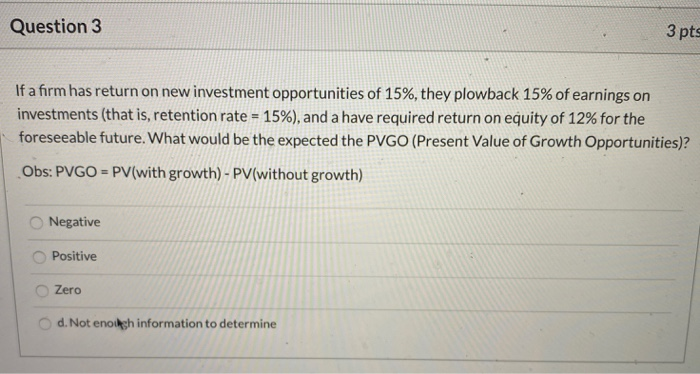

Question 3 3 pts If a firm has return on new investment opportunities of 15%, they plowback 15% of earnings on investments (that is, retention rate = 15%), and a have required return on equity of 12% for the foreseeable future. What would be the expected the PVGO (Present Value of Growth Opportunities)?! Obs: PVGO = PV(with growth) - PV(without growth) Negative Positive Zero d. Not eno imesh information to determine

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock