Question: QUESTION 3 (30 marks) Areva Resources Namibia Plc. undertook a project involving the construction of a seawater desalination plant at Wlotzkasbaken near Swakopmund. The project

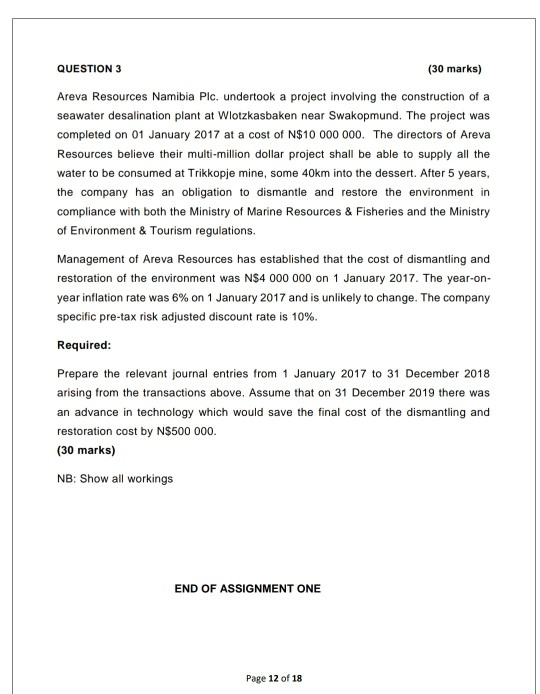

QUESTION 3 (30 marks) Areva Resources Namibia Plc. undertook a project involving the construction of a seawater desalination plant at Wlotzkasbaken near Swakopmund. The project was completed on 01 January 2017 at a cost of $10 000 000. The directors of Areva Resources believe their multi-million dollar project shall be able to supply all the water to be consumed at Trikkopje mine, some 40km into the dessert. After 5 years, the company has an obligation to dismantle and restore the environment in compliance with both the Ministry of Marine Resources & Fisheries and the Ministry of Environment & Tourism regulations. Management of Areva Resources has established that the cost of dismantling and restoration of the environment was

$4 000 000 on 1 January 2017. The year-on- year inflation rate was 6% on 1 January 2017 and is unlikely to change. The company specific pre-tax risk adjusted discount rate is 10%. Required: Prepare the relevant journal entries from 1 January 2017 to 31 December 2018 arising from the transactions above. Assume that on 31 December 2019 there was an advance in technology which would save the final cost of the dismantling and restoration cost by N$500 000. (30 marks) NB: Show all workings

QUESTION 3 (30 marks) Areva Resources Namibia Plc. undertook a project involving the construction of a seawater desalination plant at Wlotzkasbaken near Swakopmund. The project was completed on 01 January 2017 at a cost of N$10 000 000. The directors of Areva Resources believe their multi-million dollar project shall be able to supply all the water to be consumed at Trikkopje mine, some 40km into the dessert. After 5 years, the company has an obligation to dismantle and restore the environment in compliance with both the Ministry of Marine Resources & Fisheries and the Ministry of Environment & Tourism regulations. Management of Areva Resources has established that the cost of dismantling and restoration of the environment was N$4 000 000 on 1 January 2017. The year-on- year inflation rate was 6% on 1 January 2017 and is unlikely to change. The company specific pre-tax risk adjusted discount rate is 10% Required: Prepare the relevant journal entries from 1 January 2017 to 31 December 2018 arising from the transactions above. Assume that on 31 December 2019 there was an advance in technology which would save the final cost of the dismantling and restoration cost by N$500 000. (30 marks) NB: Show all workings END OF ASSIGNMENT ONE Page 12 of 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts