Question: QUESTION 3 30 MARKS Namic Inclusive CC is currently preparing budgets for the three months of the trading year. You have been provided with the

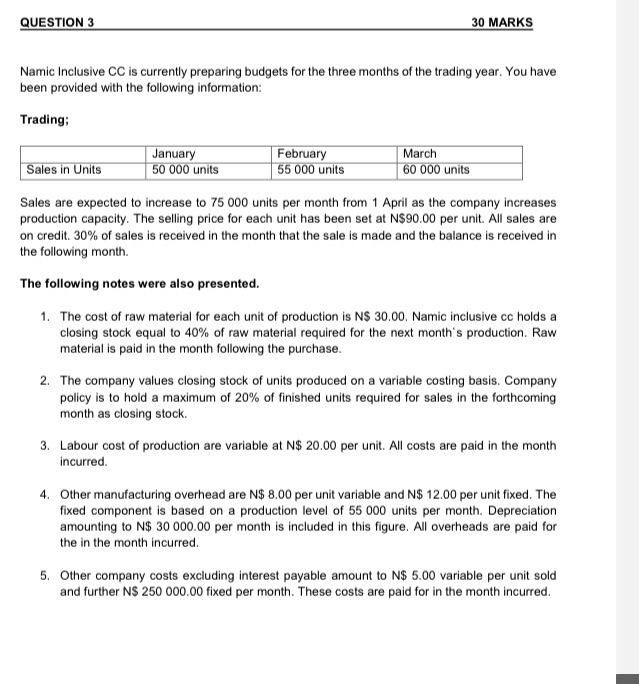

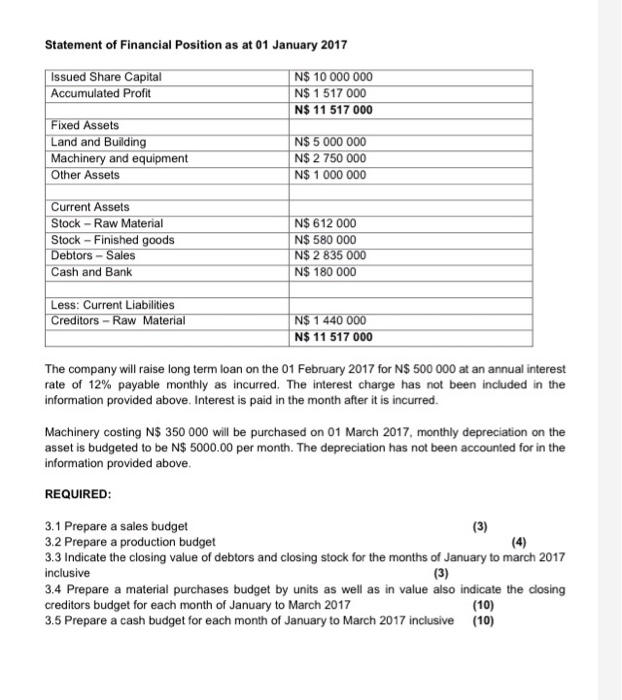

QUESTION 3 30 MARKS Namic Inclusive CC is currently preparing budgets for the three months of the trading year. You have been provided with the following information: Trading January February March its units units Sales are expected to increase to 75 000 units per month from 1 April as the company increases production capacity. The selling price for each unit has been set at N$90.00 per unit. All sales are on credit, 30% of sales is received in the month that the sale is made and the balance is received in the following month. The following notes were also presented. 1. The cost of raw material for each unit of production is NS 30.00. Namic inclusive cc holds a closing stock equal to 40% of raw material required for the next month's production. Raw material is paid in the month following the purchase 2. The company values closing stock of units produced on a variable costing basis. Company policy is to hold a maximum of 20% of finished units required for sales in the forthcoming month as closing stock 3. Labour cost of production are variable at N$ 20.00 per unit. All costs are paid in the month incurred 4. Other manufacturing overhead are N$ 8.00 per unit variable and N$ 12.00 per unit fixed. The fixed component is based on a production level of 55 000 units per month. Depreciation amounting to N$ 30 000.00 per month is included in this figure. All overheads are paid for the in the month incurred 5. Other company costs excluding interest payable amount to N$ 5.00 variable per unit sold and further NS 250 000.00 fixed per month. These costs are paid for in the month incurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts