Question: Question 3 (30 marks) Your investment client asks for information concerning the benefits of active portfolio management. She is particularly interested in the question of

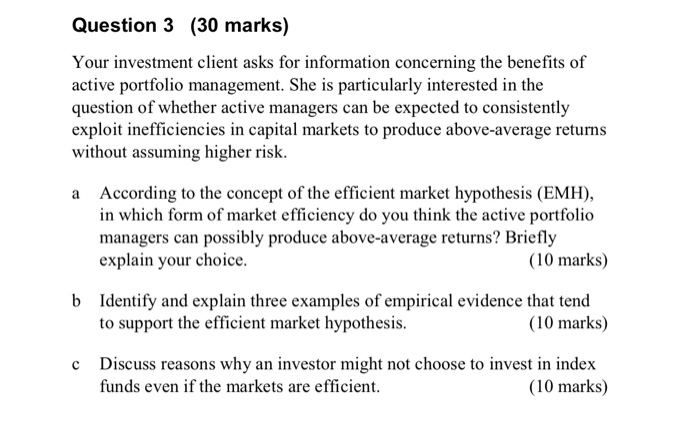

Question 3 (30 marks) Your investment client asks for information concerning the benefits of active portfolio management. She is particularly interested in the question of whether active managers can be expected to consistently exploit inefficiencies in capital markets to produce above-average returns without assuming higher risk. According to the concept of the efficient market hypothesis (EMH), in which form of market efficiency do you think the active portfolio managers can possibly produce above-average returns? Briefly explain your choice. a (10 marks) b Identify and explain three examples of empirical evidence that tend to support the efficient market hypothesis (10 marks) Discuss reasons why an investor might not choose to invest in index funds even if the markets are efficient c (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts