Question: Question 3 (33 marks) Rocky Crest Project Development Ltd (RCPD) is a Namibian company that earns revenue from undertaking various projects. Currently the company is

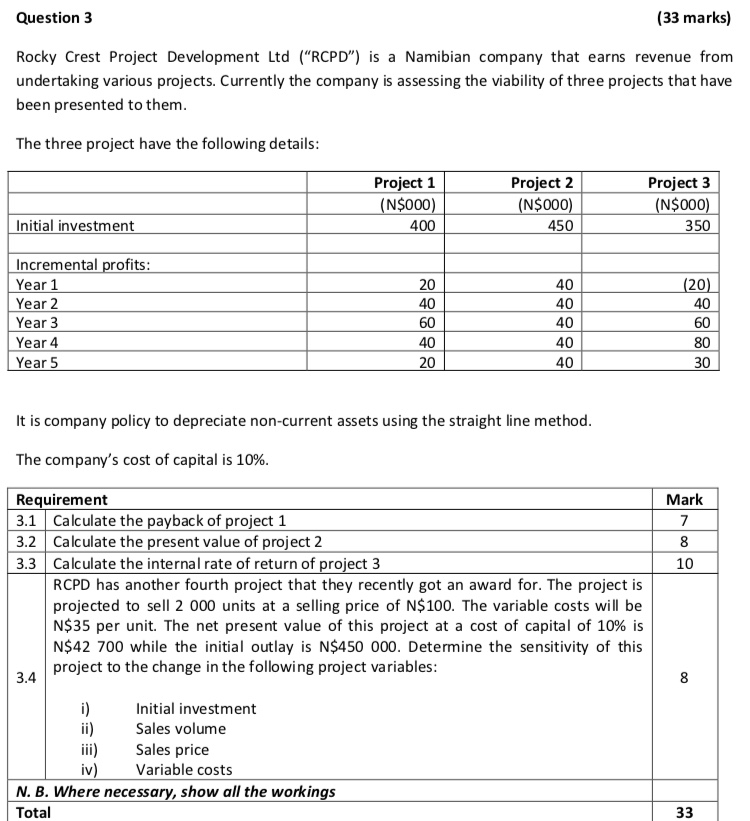

Question 3 (33 marks) Rocky Crest Project Development Ltd ("RCPD") is a Namibian company that earns revenue from undertaking various projects. Currently the company is assessing the viability of three projects that have been presented to them. The three project have the following details: Project 1 (N$000) 400 Project 2 (N$ 000) 450 Project 3 (N$ 000) 350 Initial investment Incremental profits: Year 1 Year 2 Year 3 Year 4 Year 5 20 40 60 40 40 40 40 40 40 (20) 40 60 80 30 20 It is company policy to depreciate non-current assets using the straight line method. The company's cost of capital is 10%. Mark 7 8 10 Requirement 3.1 Calculate the payback of project 1 3.2 Calculate the present value of project 2 3.3 Calculate the internal rate of return of project 3 RCPD has another fourth project that they recently got an award for. The project is projected to sell 2 000 units at a selling price of N$100. The variable costs will be N$35 per unit. The net present value of this project at a cost of capital of 10% is N$42 700 while the initial outlay is N$450 000. Determine the sensitivity of this project to the change in the following project variables: 3.4 8 i) Initial investment ii) Sales volume iii) Sales price Variable costs N. B. Where necessary, show all the workings Total iv) 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts