Question: Question 3 34 Marks Part A 12 Marks Ben Apple is employed at Bakers Biscuits CC which has a financial year end of 30th June

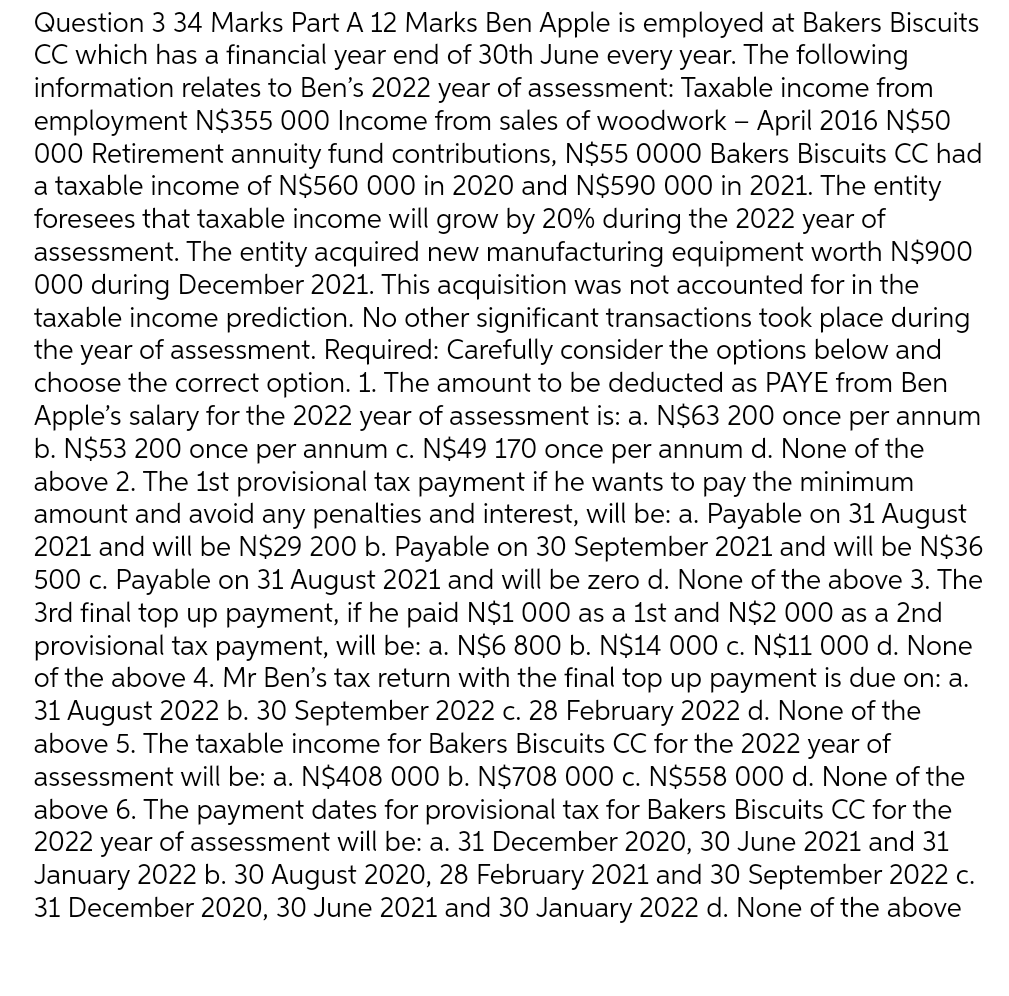

Question 3 34 Marks Part A 12 Marks Ben Apple is employed at Bakers Biscuits CC which has a financial year end of 30th June every year. The following information relates to Ben's 2022 year of assessment: Taxable income from employment N$355 000 Income from sales of woodwork April 2016 N550 000 Retirement annuity fund contributions, NS55 0000 Bakers Biscuits CC had a taxable income of N3560 000 in 2020 and N5590 000 in 2021. The entity foresees that taxable income will grow by 20% during the 2022 year of assessment. The entity acquired new manufacturing equipment worth N3900 000 during December 2021. This acquisition was not accounted for in the taxable income prediction. No other significant transactions took place during the year of assessment. Required: Carefully consider the options below and choose the correct option. 1. The amount to be deducted as PAYE from Ben Apple's salary for the 2022 year of assessment is: a. N363 200 once per annum b. N$53 200 once per annum c. N549 170 once per annum d. None of the above 2. The lst provisional tax payment if he wants to pay the minimum amount and avoid any penalties and interest, will be: a. Payable on 31 August 2021 and will be N$29 200 b. Payable on 30 September 2021 and will be N$36 500 c. Payable on 31 August 2021 and will be zero d. None of the above 3. The 3rd final top up payment, if he paid N31 000 as a lst and NS2 000 as a 2nd provisional tax payment, will be: a. N$6 800 b. N$14 000 c. N$11 000 d. None of the above 4. Mr Ben's tax return with the final top up payment is due on: a. 31 August 2022 b. 30 September 2022 c. 28 February 2022 d. None of the above 5. The taxable income for Bakers Biscuits CC for the 2022 year of assessment will be: a. NS408 000 b. N5708 000 c. NSSSB 000 d. None of the above 6. The payment dates for provisional tax for Bakers Biscuits CC for the 2022 year of assessment will be: a. 31 December 2020, 30 June 2021 and 31 January 2022 b. 30 August 2020, 28 February 2021 and 30 September 2022 c. 31 December 2020, 30 June 2021 and 30 January 2022 d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts