Question: Question 3 (35 points) (a) (12 points) Consider the CAPM model regression results for stock A and stock B: RA Rf = -1% +0.4(RM Rp)

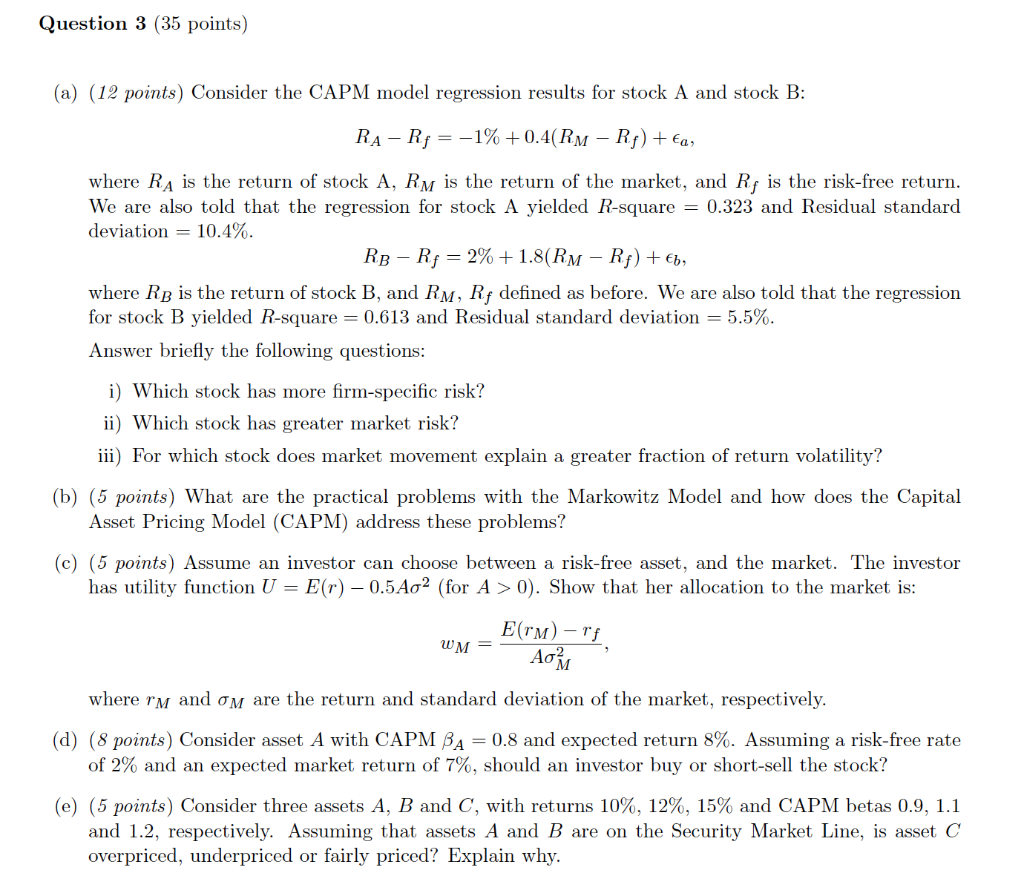

Question 3 (35 points) (a) (12 points) Consider the CAPM model regression results for stock A and stock B: RA Rf = -1% +0.4(RM Rp) + fa, where RA is the return of stock A, RM is the return of the market, and R, is the risk-free return. We are also told that the regression for stock A yielded R-square = 0.323 and Residual standard deviation = 10.4%. RB Rf = 2% +1.8(RM Rf) + b, where Rp is the return of stock B, and RM, Rf defined as before. We are also told that the regression for stock B yielded R-square = 0.613 and Residual standard deviation = 5.5%. Answer briefly the following questions: i) Which stock has more firm-specific risk? ii) Which stock has greater market risk? iii) For which stock does market movement explain a greater fraction of return volatility? (b) (5 points) What are the practical problems with the Markowitz Model and how does the Capital Asset Pricing Model (CAPM) address these problems? (c) (5 points) Assume an investor can choose between a risk-free asset, and the market. The investor has utility function U = E(r) 0.5A02 (for A > 0). Show that her allocation to the market is: E(TM) -1f WM Ao where rm and om are the return and standard deviation of the market, respectively. (d) (8 points) Consider asset A with CAPM BA = 0.8 and expected return 8%. Assuming a risk-free rate of 2% and an expected market return of 7%, should an investor buy or short-sell the stock? (e) (5 points) Consider three assets A, B and C, with returns 10%, 12%, 15% and CAPM betas 0.9, 1.1 and 1.2, respectively. Assuming that assets A and B are on the Security Market Line, is asset C overpriced, underpriced or fairly priced? Explain why. Question 3 (35 points) (a) (12 points) Consider the CAPM model regression results for stock A and stock B: RA Rf = -1% +0.4(RM Rp) + fa, where RA is the return of stock A, RM is the return of the market, and R, is the risk-free return. We are also told that the regression for stock A yielded R-square = 0.323 and Residual standard deviation = 10.4%. RB Rf = 2% +1.8(RM Rf) + b, where Rp is the return of stock B, and RM, Rf defined as before. We are also told that the regression for stock B yielded R-square = 0.613 and Residual standard deviation = 5.5%. Answer briefly the following questions: i) Which stock has more firm-specific risk? ii) Which stock has greater market risk? iii) For which stock does market movement explain a greater fraction of return volatility? (b) (5 points) What are the practical problems with the Markowitz Model and how does the Capital Asset Pricing Model (CAPM) address these problems? (c) (5 points) Assume an investor can choose between a risk-free asset, and the market. The investor has utility function U = E(r) 0.5A02 (for A > 0). Show that her allocation to the market is: E(TM) -1f WM Ao where rm and om are the return and standard deviation of the market, respectively. (d) (8 points) Consider asset A with CAPM BA = 0.8 and expected return 8%. Assuming a risk-free rate of 2% and an expected market return of 7%, should an investor buy or short-sell the stock? (e) (5 points) Consider three assets A, B and C, with returns 10%, 12%, 15% and CAPM betas 0.9, 1.1 and 1.2, respectively. Assuming that assets A and B are on the Security Market Line, is asset C overpriced, underpriced or fairly priced? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts