Question: Question 3 & 4 1 Normal 1 No Spac... Heading 1 Heading 2 Title E Paragraph Styles 2 G 4 Discussion Questions: The Intelligent Investor

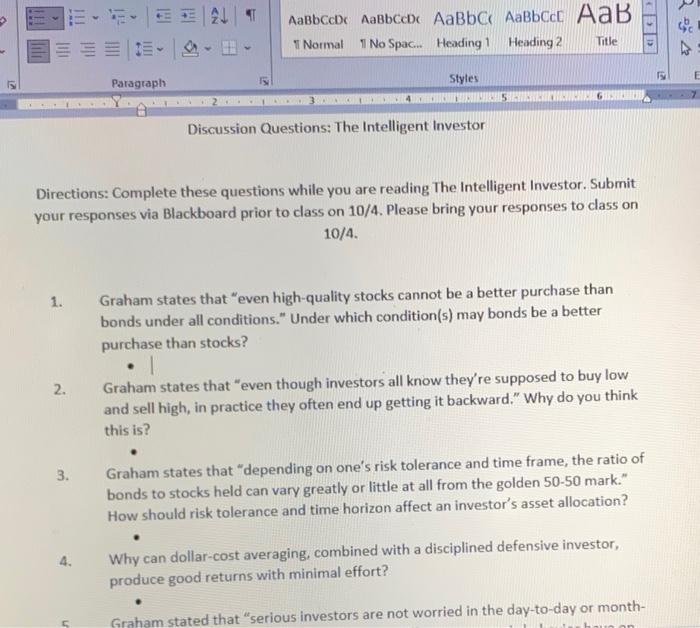

1 Normal 1 No Spac... Heading 1 Heading 2 Title E Paragraph Styles 2 G 4 Discussion Questions: The Intelligent Investor Directions: Complete these questions while you are reading The Intelligent Investor. Submit your responses via Blackboard prior to class on 10/4. Please bring your responses to class on 10/4. 1. Graham states that even high-quality stocks cannot be a better purchase than bonds under all conditions. Under which condition(s) may bonds be a better purchase than stocks? 2. Graham states that even though investors all know they're supposed to buy low and sell high, in practice they often end up getting it backward." Why do you think this is? 3. Graham states that "depending on one's risk tolerance and time frame, the ratio of bonds to stocks held can vary greatly or little at all from the golden 50-50 mark." How should risk tolerance and time horizon affect an investor's asset allocation? 4. Why can dollar-cost averaging, combined with a disciplined defensive investor, produce good returns with minimal effort? Graham stated that "serious investors are not worried in the day-to-day or month- 1 Normal 1 No Spac... Heading 1 Heading 2 Title E Paragraph Styles 2 G 4 Discussion Questions: The Intelligent Investor Directions: Complete these questions while you are reading The Intelligent Investor. Submit your responses via Blackboard prior to class on 10/4. Please bring your responses to class on 10/4. 1. Graham states that even high-quality stocks cannot be a better purchase than bonds under all conditions. Under which condition(s) may bonds be a better purchase than stocks? 2. Graham states that even though investors all know they're supposed to buy low and sell high, in practice they often end up getting it backward." Why do you think this is? 3. Graham states that "depending on one's risk tolerance and time frame, the ratio of bonds to stocks held can vary greatly or little at all from the golden 50-50 mark." How should risk tolerance and time horizon affect an investor's asset allocation? 4. Why can dollar-cost averaging, combined with a disciplined defensive investor, produce good returns with minimal effort? Graham stated that "serious investors are not worried in the day-to-day or month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts