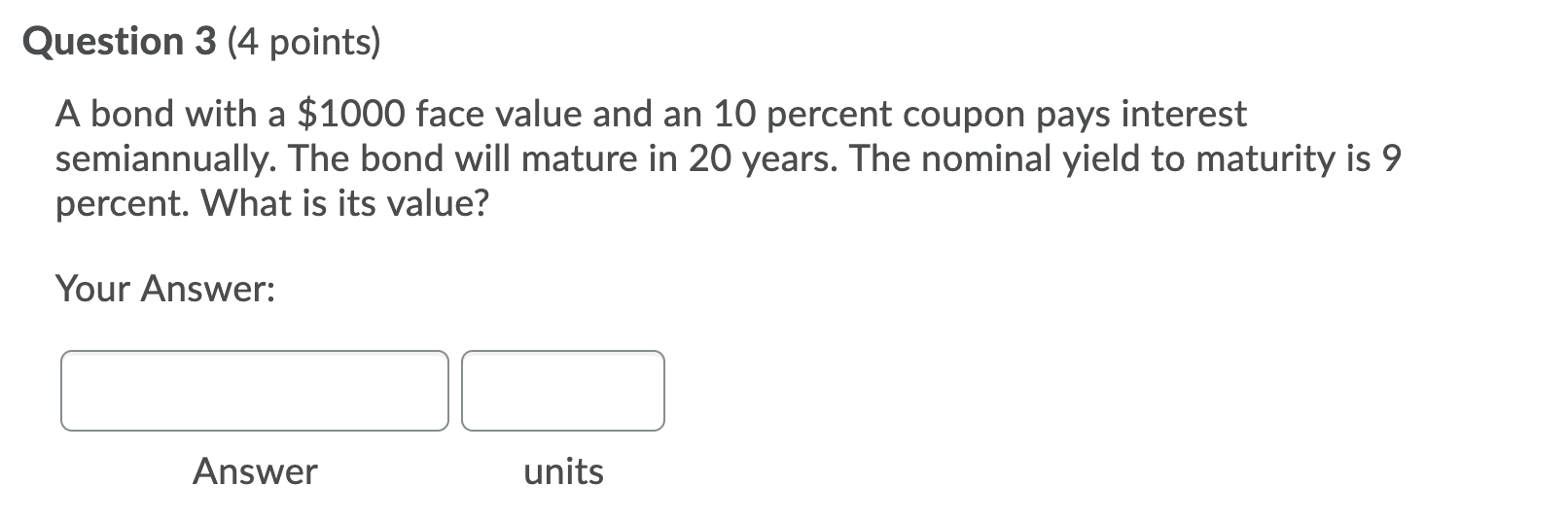

Question: Question 3 (4 points) A bond with a $1000 face value and an 10 percent coupon pays interest semiannually. The bond will mature in 20

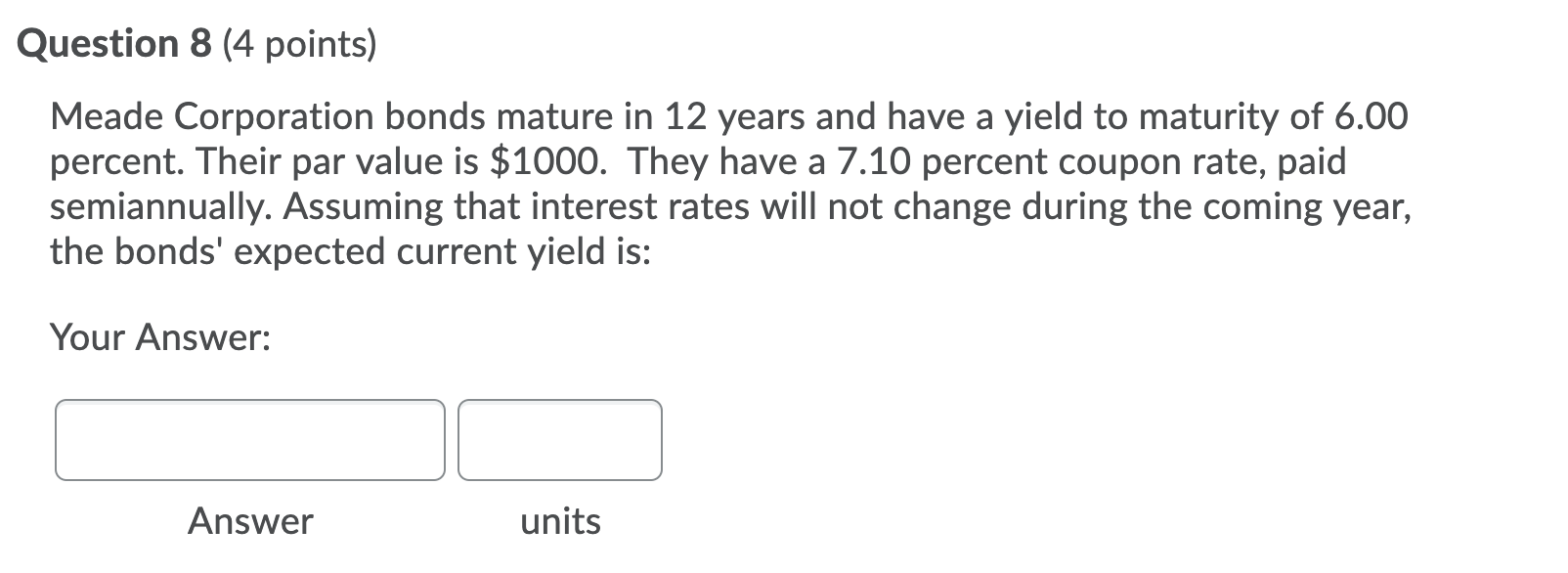

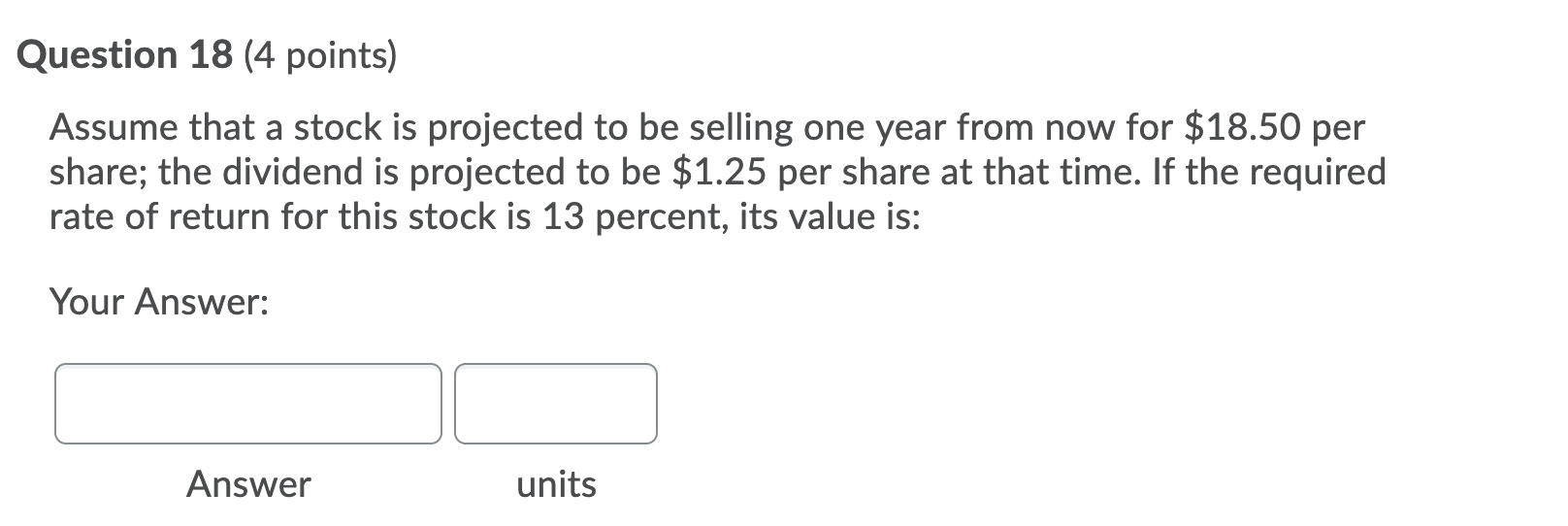

Question 3 (4 points) A bond with a $1000 face value and an 10 percent coupon pays interest semiannually. The bond will mature in 20 years. The nominal yield to maturity is 9 percent. What is its value? Your Answer: Answer units Question 8 (4 points) Meade Corporation bonds mature in 12 years and have a yield to maturity of 6.00 percent. Their par value is $1000. They have a 7.10 percent coupon rate, paid semiannually. Assuming that interest rates will not change during the coming year, the bonds' expected current yield is: Your Answer: Answer units Question 18 (4 points) Assume that a stock is projected to be selling one year from now for $18.50 per share; the dividend is projected to be $1.25 per share at that time. If the required rate of return for this stock is 13 percent, its value is: Your Answer: Answer units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts