Question: Question 3 (4 points) Bob and Sally's mortgage payment increases to $1632.00. Their roof starts to leak and they need to replace it. They budget

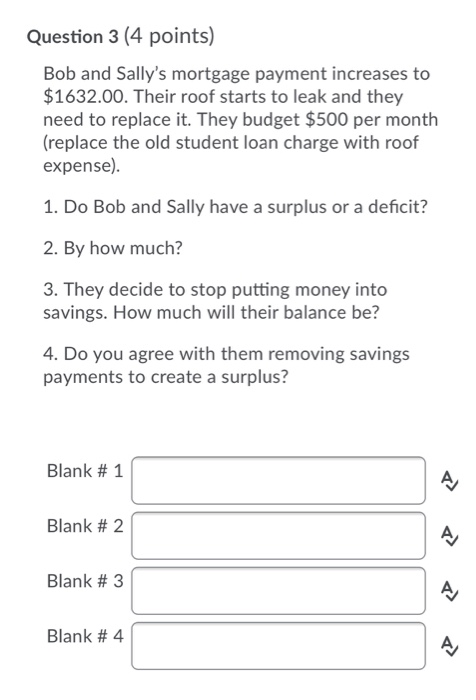

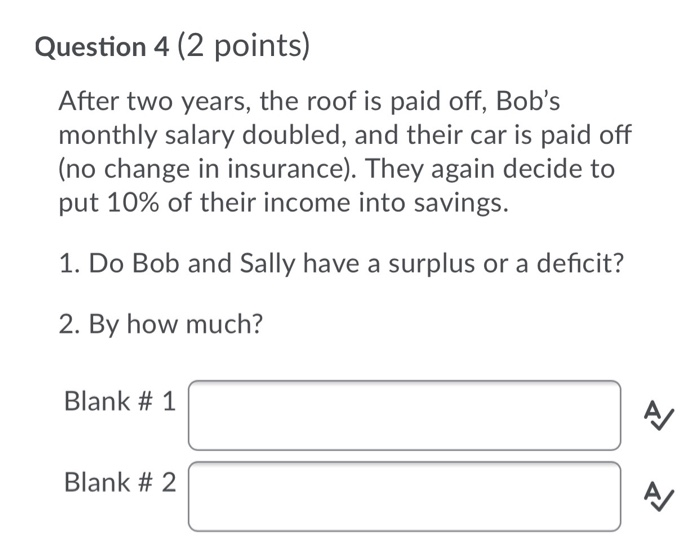

Question 3 (4 points) Bob and Sally's mortgage payment increases to $1632.00. Their roof starts to leak and they need to replace it. They budget $500 per month (replace the old student loan charge with roof expense) 1. Do Bob and Sally have a surplus or a deficit? 2. By how much? 3. They decide to stop putting money into savings. How much will their balance be? 4. Do you agree with them removing savings payments to create a surplus? Blank # 1 Blank # 2 Blank # 3 Blank #4 Question 4 (2 points) After two years, the roof is paid off, Bob's monthly salary doubled, and their car is paid off (no change in insurance). They again decide to put 10% of their income into savings. 1. Do Bob and Sally have a surplus or a deficit? 2. By how much? Blank # 1 Blank #2 Question 3 (4 points) Bob and Sally's mortgage payment increases to $1632.00. Their roof starts to leak and they need to replace it. They budget $500 per month (replace the old student loan charge with roof expense) 1. Do Bob and Sally have a surplus or a deficit? 2. By how much? 3. They decide to stop putting money into savings. How much will their balance be? 4. Do you agree with them removing savings payments to create a surplus? Blank # 1 Blank # 2 Blank # 3 Blank #4 Question 4 (2 points) After two years, the roof is paid off, Bob's monthly salary doubled, and their car is paid off (no change in insurance). They again decide to put 10% of their income into savings. 1. Do Bob and Sally have a surplus or a deficit? 2. By how much? Blank # 1 Blank #2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts