Question: Question 3 (4 points) On September 1, 2021, PC Inc. purchased a machine for $124,670. The machine has an estimated useful life of 8 years

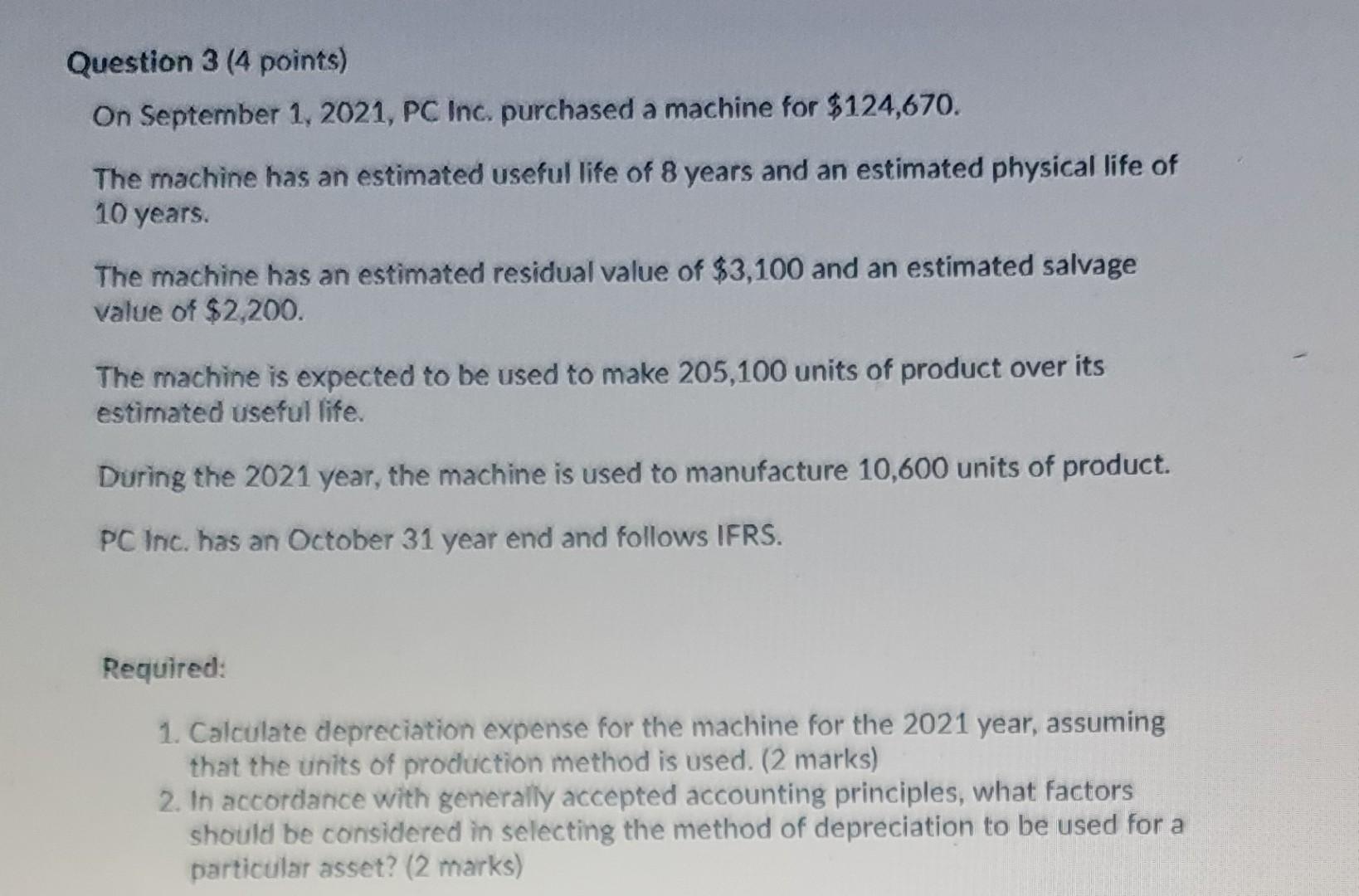

Question 3 (4 points) On September 1, 2021, PC Inc. purchased a machine for $124,670. The machine has an estimated useful life of 8 years and an estimated physical life of 10 years. The machine has an estimated residual value of $3,100 and an estimated salvage value of $2,200. The machine is expected to be used to make 205,100 units of product over its estimated useful life. During the 2021 year, the machine is used to manufacture 10,600 units of product. PC Inc. has an October 31 year end and follows IFRS. Required: 1. Calculate depreciation expense for the machine for the 2021 year, assuming that the units of production method is used. (2 marks) 2. In accordance with generally accepted accounting principles, what factors should be considered in selecting the method of depreciation to be used for a particular asset? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts