Question: Question 3 (4 points) The Rubber Division is considering selling 3,000 kilograms (kg) of rubber to the Tire Division of the same company. Rubber Division

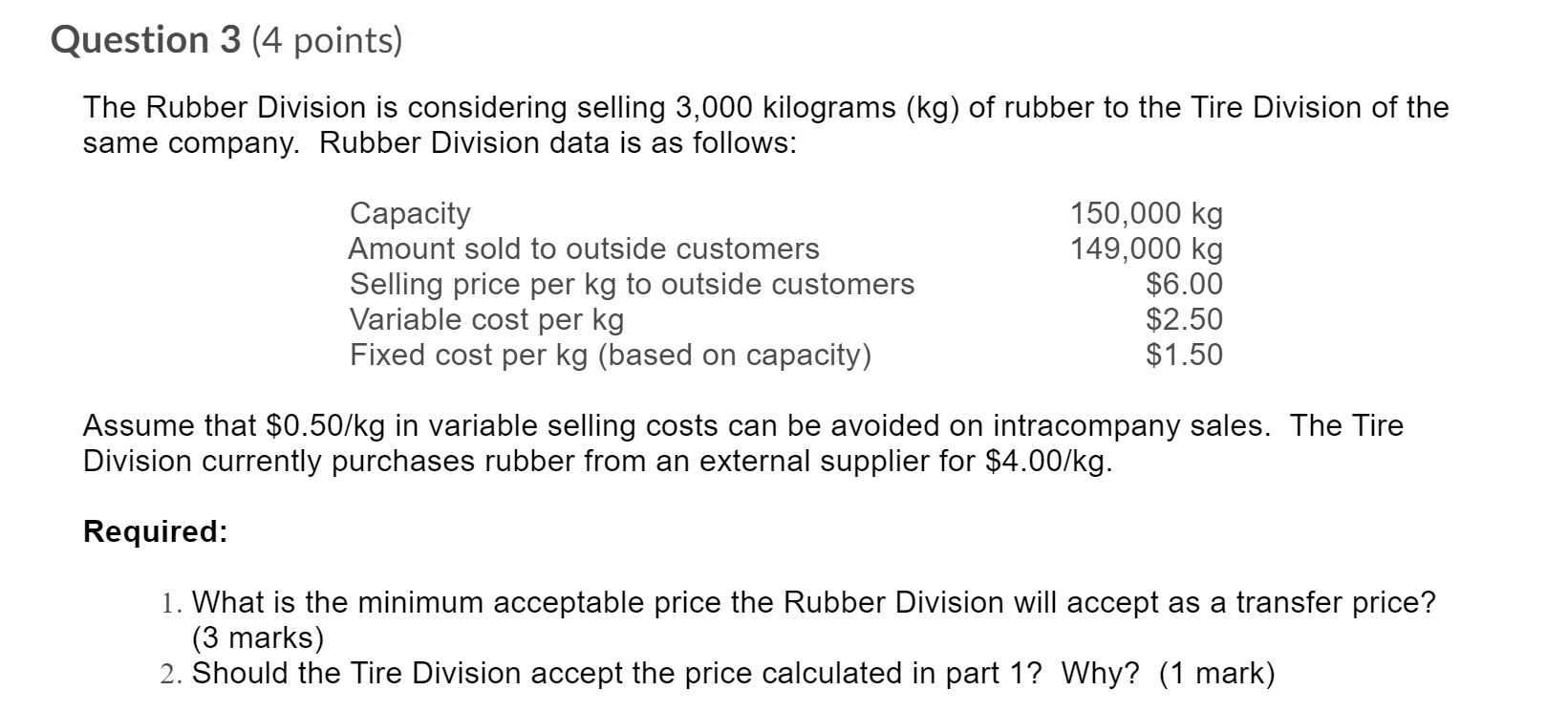

Question 3 (4 points) The Rubber Division is considering selling 3,000 kilograms (kg) of rubber to the Tire Division of the same company. Rubber Division data is as follows: Capacity Amount sold to outside customers Selling price per kg to outside customers Variable cost per kg Fixed cost per kg (based on capacity) 150,000 kg 149,000 kg $6.00 $2.50 $1.50 Assume that $0.50/kg in variable selling costs can be avoided on intracompany sales. The Tire Division currently purchases rubber from an external supplier for $4.00/kg. Required: 1. What is the minimum acceptable price the Rubber Division will accept as a transfer price? (3 marks) 2. Should the Tire Division accept the price calculated in part 1? Why? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts