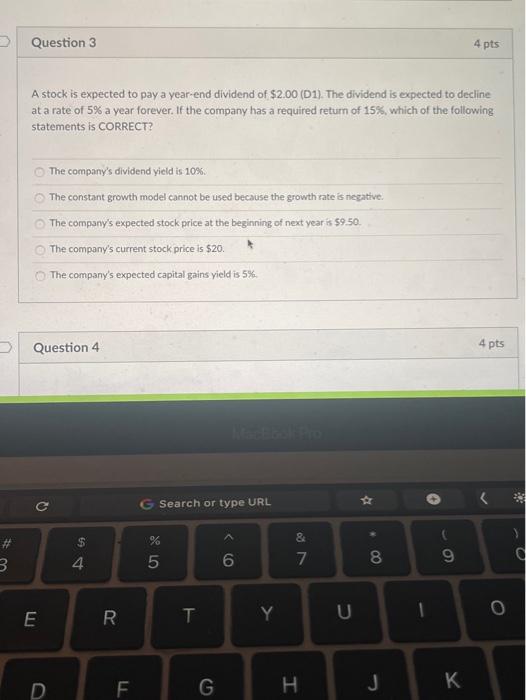

Question: Question 3 4 pts A stock is expected to pay a year-end dividend of $2.00 (D1). The dividend is expected to decline at a rate

Question 3 4 pts A stock is expected to pay a year-end dividend of $2.00 (D1). The dividend is expected to decline at a rate of 5% a year forever. If the company has a required return of 15%, which of the following statements is CORRECT? The company's dividend yield is 10% The constant growth model cannot be used because the growth rate is negative. The company's expected stock price at the beginning of next year's 59.50 The company's current stock price is $20. The company's expected capital gains yield is 5% Question 4 4 pts 22 Q G Search or type URL & # 0) > 4 3 5 d 7 8 9 U T E Y 1 R O F D G H J

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock