Question: Question 3 4 pts An effective way to immunize your portfolio to interest rate changes is to match the maturities of liabilities and assets to

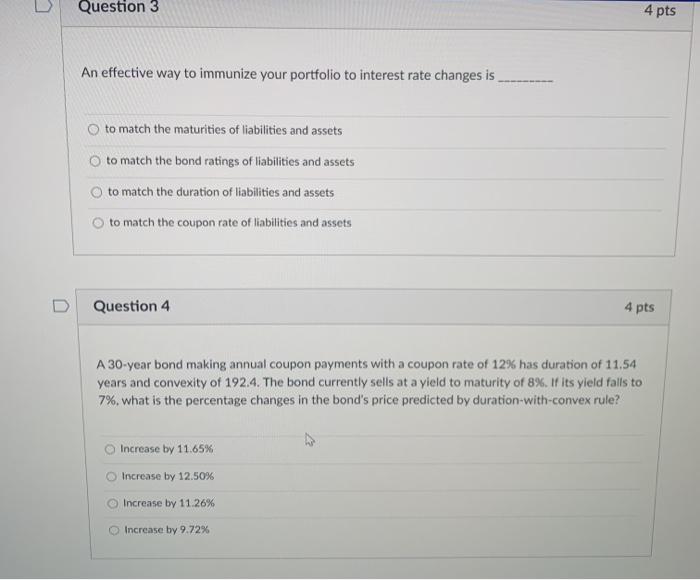

Question 3 4 pts An effective way to immunize your portfolio to interest rate changes is to match the maturities of liabilities and assets to match the bond ratings of liabilities and assets to match the duration of liabilities and assets to match the coupon rate of liabilities and assets D Question 4 4 pts A 30-year bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and convexity of 192.4. The bond currently sells at a yield to maturity of 8%. If its yield falls to 7%, what is the percentage changes in the bond's price predicted by duration-with-convex rule? Increase by 11.65% Increase by 12.50% Increase by 11.26% Increase by 9.72%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts